Andreessen Horowitz Startup Metrics Template

Andreessen Horowitz (a16z) is one of the most prolific VC investors in the market today. With investments across a number of different stages, sectors, and business models, they have seen first hand the lack of (and the need for) standardization in the way private technology companies track metrics and present those metrics to current and potential stakeholders.

While their well known post, called “16 Startup Metrics“, dives deep into a number of great metrics for different business models – Marketplaces and Ecommerce in particular – we focused this video on SaaS metrics and how companies can use Visible templates along with other sources to benchmark themselves against others in the market and set themselves up for fundraising success.

For benchmarking purposes, we leaned on this year’s Pacific Crest SaaS Survey. With over 300 respondents representing different geographies and sizes, the survey provides very actionable insight into how your company is performing relative to others in the market.

Pacific Crest Respondents

SaaS Revenue and Profitability Metrics

In our example, we are looking at a SaaS company with Total Annual Revenue of just under $2 million (we’ll call them ExCo.). At this size, it it likely they would be going out to raise a Series A round of funding.

MRR vs. Service Revenue

There are generally two types of revenue for a SaaS company – the first is Subscription Revenue (called MRR or ARR). This is product focused revenue that is recurring and predictable — especially if you are able to sign customers to longer term agreements. Investors prefer this type of revenue because it signals a high quality product with a path to long-term profitability.

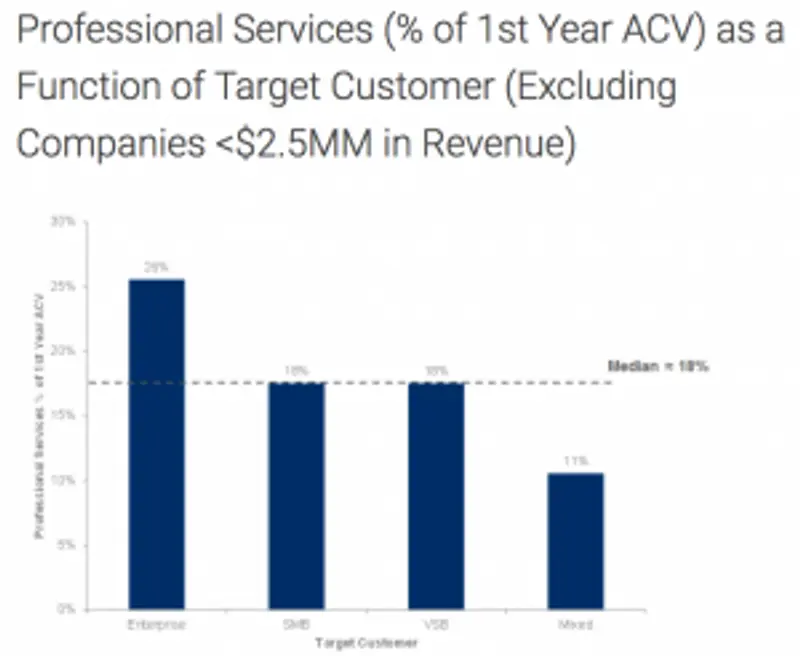

The second type of revenue is Services Revenue which often comes in the form on one-off (read: not predictable) consulting engagements or implementation fees. Because of the human-capital intensive nature of providing these services, they are far less profitable and scalable than Subscription Revenue.

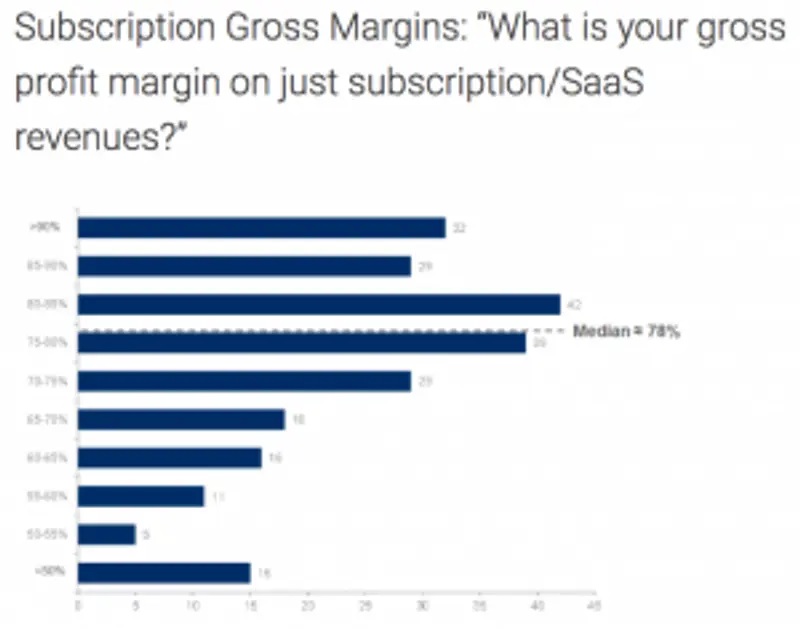

According to the Pacific Crest SaaS Survey, the median gross margin on subscription revenue is almost 80% while the margin on professional services in under 20%

Average Contract Value (ACV)

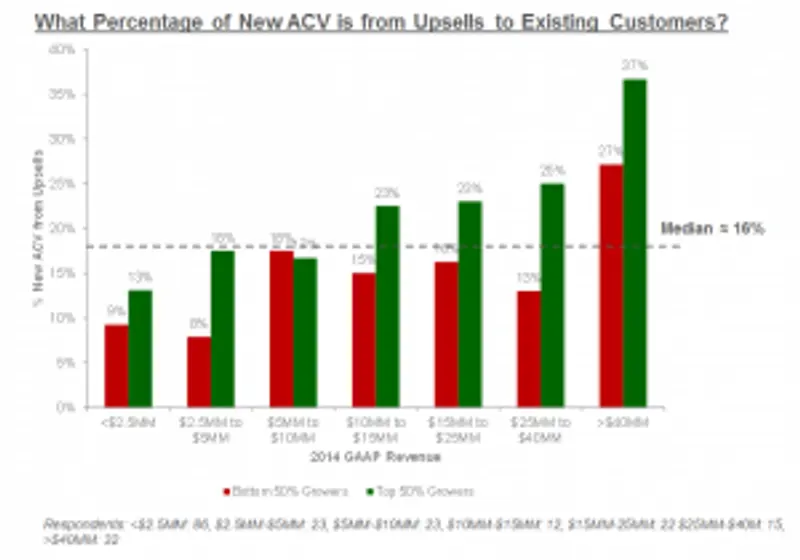

As defined in the a16z post, ACV is “the value of the contract over a 12-month period.” If you are seeing an uptrend in ACV over time (which is generally the goal), then your company is likely doing one or many of the following things:

- Shifting to customers with a larger budget – more seats, usage, etc.

- Employing a more effective sales strategy to convince customers to invest more heavily in your product

- Building a product that continues to improve and provide increasing value

- Effectively upselling existing customers

SaaS Gross Profit Margin

Growing the top line is necessary to build a scalable business but in order to build a sustainable company – or raise capital that helps get you to that point – your profitability (in this case, we are looking at Gross Margin) must be trending in the right direction.

Here, we see Gross Margin increase initially and then fall off in recent periods. This could result from a number of factors:

- Churn from high margin customers

- Pricing pressure from new entrants or large players

- Lower percentage of revenue coming from MRR (subscription revenue)

- An increase in the infrastructure required to deliver the product (server costs, support costs, etc.)

In the case of ExCo. we know that ACV is moving up and that the revenue stream is becoming more and more weighted towards subscription revenue so we can rule out a couple of potential causes. What is likely occurring is an increase in the infrastructure required to deliver the product (server costs, support costs, etc.). When the numbers change, it is crucial to know why and to be able to present context and a path forward when discussing those changes with investors.

In spite of the dip, ExCo.’s gross margin still remains in the same ballpark relative to others in the market and is higher than it was the previous year.

As your company moves further and further through the Venture fundraising lifecycle – from Seed to A to Growth rounds – the numbers gain importance in the overall story for the fundraise. The metrics above provide a quick glimpse of high level figures that can be very useful in getting in a foot in the door with some investors — strong MRR growth, a robust Sales Pipeline, growth in the commitment of future revenue (known as Bookings), and low Churn Rate (among many other factors) can also play a significant role in the success of your fundraise and in the long term viability of the business.