Blog

Reporting

Resources to help level up your investor reporting.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

investors

Reporting

Customer Stories

[Webinar Recording] Best Practices for Portfolio Monitoring & Reporting With Gale Wilkinson

As more capital flows into venture as an asset class, investors increasingly compete for LP dollars and space on the cap table from the best founders they work with. Gone are the days when capital is enough of a differentiator for a VC fund to get on a hot startup’s cap table.

Considering the average VC + Founder relationship is 8-10 years (longer than the average marriage in the US) — founders are beginning to look for a true partner out of a VC fund. For a VC fund or emerging fund manager to stand out among other funds, they need to have the optimal data and systems in place.

Gale Wilkinson, Managing Partner and Founder of Vitalize Ventures, has led investments in over 70 companies and deployed $50M+ of capital. During her time at Vitalize and Irish Angels, Gale has turned into a leader in the space as emerging managers and founders turn to her for advice on all aspects of fund and startup building.

Gale joined us on February 15, 2022 to discuss how and why VC funds should build a system to track and monitor their portfolio companies.

Topics discussed during the webinar include:

The history and founding of Vitalize Ventures

The resources, network, communities, that has Gale has leveraged as she grows her managing partner skillset

How she put together the Vitalize tech stack

What metrics and data she collects from portfolio companies

How she reports portfolio performance to her LPs

Visible for Investors is a founders-first portfolio monitoring and reporting platform. Schedule time with our team to learn more.

founders

Fundraising

Reporting

How to Build an Investor List with Gale Wilkinson of Vitalize

On episode 10 of the Founders Forward Podcast, we welcome Gale Wilkinson. Gale is the Managing Partner at Vitalize Ventures — “an early-stage fund & angel community investing in software focused on future of work and future of learning.”

About Gale

Before starting Vitalize, Gale started her career in venture capital at Irish Angels. Gale is one of our favorite follows on Twitter where she shares tactical tips for founders on fundraising. She joins us to break down some of her most popular threads on Twitter and offers countless takeaways to help early-stage founders fundraise — covering everything from list building to ownership benchmarks.

Our CEO, Mike Preuss, had the opportunity to sit down and chat with Gale. You can give the full episode a listen below (Or listen on Spotify, Apple Podcasts, or any standard podcast player):

What You Can Expect to Learn from Gale

How VC has changed over the last 10 years

Why Vitalize is launching an angel group

Why list building is vital to a successful fundraise

How many investors a founder should expect to talk to during a raise

What catches her eye in a cold email from a founder

What she looks for in a pitch deck

Why she cares about financial modeling at the early stages

Related Resources

Gale’s Twitter

Gale’s LinkedIn

Vitalize’s Visible Connect Profile

[Thread] Gale on Cold Emails

[Thread] Gale on Data Rooms

[Blog] How Long Does Fundraising Take?

investors

Reporting

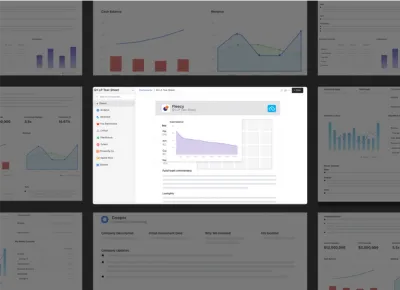

4 Tear Sheet Examples to Give You Inspiration for Your Next LP Report

Tear Sheets (also known as one-pagers or fact sheets) are an effective way to communicate the performance of your portfolio on an individual company level. In Venture Capital, tear sheets are commonly shared with Limited Partners (LPs) on a monthly or quarterly basis to keep investors updated on company performance.

Common Tear Sheet Elements

Some common elements that should be included in tear sheets are:

Investment performance – Cost, value, board information

Financial metrics – Revenue, Cash Balance, Burn Rate, Runway

Company-specific KPIs – Keep this consistent for each reporting cycle.

Commentary – Add your own analysis on company metrics and performance.

Company context – Include details such as the company description, sector, HQ location for context.

Download Our Tear Sheet Examples

Download our packet of Tear Sheet Examples built with Visible.vc’s software for investors for inspiration before your next reporting cycle:

With Visible.vc you can create professionally formatted Tear Sheets for your entire portfolio within minutes. To learn more, schedule a demo with our team.

founders

Fundraising

Reporting

10 Fundraising Takeaways from Season 2 of the Founders Forward

We are just over halfway through season 2 of the Founders Forward. We’ve talked to 6 awesome investors and have dug into everything from pitch decks to mental health.

To recap the first half of the season, we’ve shared our favorite quotes and thoughts from the season so far below. If you’d rather skip to a specific episode, you can do so below:

The Supply & Demand of Venture with Kenn Shasta

One of the questions we have asked all guests this year is, “What is one tip to help founders create momentum in their fundraise?” We’ve heard a flurry of great answers but really love the advice from Kenn So of Shasta Ventures.

Kenn recommends founders start to include target investors on their monthly/quarterly Updates. This way investors already know what’s going on and have already build a trend line when it comes to your company. Give the full episode a listen below:

Creating Momentum in Your Fundraise with Brett Brohl

One of the most common mistakes we see founders make is underestimating the amount of time it takes to complete a fundraise. From finding and researching investors to signing a term sheet can take 5+ months. We love how Brett Brohl of Bread & Butter Ventures broke down a fundraise into 5 months, or 1-3-1:

1 month — Researching and finding the right investors

3 months — Actively pitching investors

1 month — Time to close after it is fully committed

To learn more fundraising tips and advice for seed-stage founders, give the full episode with Brett a listen below:

How to Create FOMO During a Fundraise with Elizabeth Yin

When going out to raise a round of capital, most founders assume that you should try to find a few large investors that can fill the round so you can be done. However, Elizabeth Yin of Hustle Fund argues that small checks can be a really powerful tool.

While there are certainly some downsides, smaller checks allow you to create momentum and build your network. Elizabeth shared an example of a portfolio company that landed one small investor who ended up introducing them to the majority of their investors. Give the full episode with Elizabeth a listen below:

Building a Calm Company with Tyler Tringas

One of the questions we have asked all guests is, “What catches your eye in a cold email from a founder?” Tyler Tringas of Calm Company Fund had a great and unique take. Tyler likes to see a quick video of the product actually working. This can help create excitement and give him an idea of the state of the product.

Give our episode with Tyler a full listen below:

How Founders Can Address Their Mental Health with Ezra Galston

Before sitting a meeting with an investor there is an expectation that you will send over some kind of pitch deck or data or synopsis. Some investors will tell you full deck. Others might suggest a mini-deck. Regardless of the medium, Ezra Galston of Starting Line just wants enough context to have a good conversation.

Sending over enough context beforehand enables Ezra to understand some basics and have enough information to dig into questions and have a strong conversation. Give our interview with Ezra a full listen below:

All Things Community-Led Growth with Corinne Riley

A seed-stage and Series A fundraise can feel quite different for a founder. At the seed stage you likely have little to no revenue, few metrics, and a simple product. By the time you get to your Series A, you likely have product-market fit and have a solid revenue base. While the business might look different, some parts of your pitch stay the same.

We love how Corinne Riley of Greylock breaks down constant things she looks for in a pitch, regardless of stage. Give the full episode with Corinne a listen below:

How Design Can be a Competitive Advantage with Kristian Andersen

A successful pitch and story can make or break a fundraise. As the co-founder of the venture studio, High Alpha, Kristian has helped countless early-stage companies craft their narratives and build their pitch deck.

In our interview with Kristian, he points out the importance of starting with your story when crafting your pitch deck.

The Past, Present, and Future of VC Funding with Anne Dwane

As a first-time founder, finding someone you can lean on for advice and experience can be crucial. Anne Dwane of Village Global recommends that founders can find a “thought partner.” This might be a peer that is someone who is at a similar stage or only a step or 2 ahead.

Determining if an Accelerator is Right For You with Lisa Besserman

The importance of being able to send a strong cold email was a consistent topic with all of our guests this season. More than anything else, Lisa Besserman of Expa likes to see a deck from a founder. In our interview with Lisa, she breaks down what specifically she likes to see in a deck as well.

How to Build an Investor List with Gale Wilkinson

Fundraising generally mirrors a traditional B2B sales funnel. Just like a sales funnel, you need leads and a strong customer profile at the top to fuel your process. Gale Wilkinson of Vitalize suggests that founders have a running list of investors that are a fit for your business.

founders

Operations

Reporting

How To Build a Board of Directors That Actually Helps

What a Board of Directors Does

Even with great executives, a great product, and a great team, the success of a new startup can be determined by its Board of Directors. Choosing a Board of Directors is a critical process. The Board of Directors for your venture are the strategic advisors or final votes in major decisions and changes. With the right Board in place, a company can accelerate and take the right strategic steps to a favorable exit or IPO.

Building a Board of Directors is a crucial process and one that should be done deliberately and strategically. Decisions about the type of board your company needs, the types of board members and how they will strategically work together, and planning ahead for potential board obstacles and stumbling points are all aspects to consider when building a Board of Directors that will actually help your company grow.

What a Board of Directors Does

At the highest level, a Board of Directors provides some type of strategic advisory and decision making for a company. In some cases, and for some types of boards, this decision-making could be fiscal and provide the board members the electoral power to make changes above the company’s executives. In other cases, it can be purely strategic, with no formal and final power but rather to serve as a collective of experience and guidance as the company grows and evolves over time. In general, a Board of Directors serves as a voting or advisory body of appointed or elected leaders that help make decisions for a company. There are nuances and three primary types of Boards of Directors.

The Different Types of Boards

Board of Directors

A Board of Directors is made up of appointed members typically representing from inside the company and outside the company. Board of Director members are experts in their field, fields relating to company leadership or aligned strategically with what a company does or what industry they serve. A Board of Directors may serve in an advisory role or a fiduciary role or both. These two types of boards are most common. Inside company representation may include leaders of the executive board and even the CEO of the company. Outside appointees vary depending on the type of Board of Directors. The type of board of directors can also influence how a specific board meeting is run. Check out our guide on How to Run a Board Meeting to learn more about the various meeting flows.

Advisory Board

The main differentiator of an advisory board is that its decisions are non-binding and more informal in nature. Just as the name suggests, Advisory Boards are composed of appointed experts that provide advice and help a company with forward-thinking decisions such as custom acquisition, go-to-market strategy, category tactics, pricing, or even acquisition decisions. Advisory Board cannot force a CEO or executive team to take any action. They are also not appointed to represent any specific interests, rather composed of folks that are experts in their field or have strong track records of scaling great businesses. Sometimes, in exchange for an Advisory Board seat and contributing their time and help to a company, the stock is given as part of the “payment” for serving in an Advisory Board role. This also ties the advisory board member to the company’s long-term success. In general, Advisory Boards do not assume any liability or responsibility legally from company decisions and outcomes.

Fiduciary Board

First and foremost, Fiduciary Boards are made up of an equal representation of all the shareholders, not just majority owners. Public companies are required to have Fiduciary Boards but Private companies are not. Fiduciary Boards are tasked with ensuring that the company is making decisions that are fiscally beneficial to its shareholders. Because of this heavy responsibility and oversight, Fiduciary Boards are given the voting rights to overrule the CEO’s decisions. Members of a Fiduciary Board are appointed by each party they represent. Often, when a big funding round takes place, the leading investor of that round will appoint a partner to sit on the Board of Directors at the company – earning a board seat as part of their investment to represent their fiduciary interests. Inside the company members are present as well including the CEO and possibly another C-level executive.

The Different Types of Board Members

Not only are there different kinds of Boards of Directors, there are also a variety of different types of board members that make up said boards.

Management Board Members

Internal representatives on a Board of Directors from the company are referred to as management board members. Management board members are direct representatives from the day-to-day of the company, often the CEO, COO or another executive leader. They provide the frontline perspective into the discussions and decision-making for the board and are often responsible for running the agenda and managing the flow of information out to the rest of the board members.

Investor Board Members

Often, when a VC firm or PE firm makes an investment into a company’s funding round, they are granted representation with a board seat. Investors that join your board at different stages of a company’s growth may have different perspectives or rationale around upholding specific decisions or fiduciary responsibility. It’s critical that you spend the time onboarding not only the board seat holder, but your broader team of new investors after every round.

Independent Directors

Knowing that management members and investor members both have direct ties to the success of the company and are personally tied financially to the outcomes decided on by a board, independent directors provide an air of checks and balances to the table. Independent directors are qualified individuals that have no affiliation or tie to the company. They may be business leaders or industry experts and are there as a 3rd party, non-bias advisors to the business.

How To Build a Strong Board of Directors

Now knowing that there are various types of a Board of Directors and various members that make up those ranks, the decision-making process begins to form the perfect board for your company’s needs and future.

Choosing a Board Type

First and foremost, if your company is public, a fiduciary board is required. However, if your company is private, you have the option to build a board with just advisory duties or to grant them fiduciary power as well. It’s important to consider why each function exists. Choosing an advisory board is smart for any founder to make sure their company building does not exist in an echo chamber, and insight and advice is considered early and often as the company scales. The more external funding you take and the more shareholders are present, fiduciary responsibility may make the most sense to protect the overall interests of the company and spread out the risk and legal responsibility amongst shareholders, not just on the executive leadership at the company.

Deciding on a Board Size

There is no mandatory set number of Board Members, and most range from 3 to 31 employees. Typically a board is always composed of an odd number to prevent tied votes. Analysts suggest that the ideal Board of Directors size is 7 members. Deciding on your Board size is up to you as a founder. Perhaps a smaller board is good to start with expansions being made as more investors come to the table, earning more seats, or as new problems or growth opportunities arise at the company that requires new expertise to be brought in.

Establishing a Board Structure

In addition to Board of Directors Size and Type, the structure of the board is critical to the success of the board. Having a clear, and defined structure that is agreed upon by members as they join ensures that board meetings are run smoothly and the purpose and goals of the board are clearly achieved. Structural elements of a board to consider include setting clear bylaws that outline member responsibilities and expectations, defined roles, and duties such as who will take minutes, who will report out, and who will run the meeting flow at each board meeting. Term limits are also something to consider, especially for a fiduciary board, to keep decision-making ethical and tied to the best interests of the shareholders. Additionally, check if your specific industry or board type has any industry or corporate governance rules that are needed to be abided by.

Fill Knowledge and Skills Gaps

When appointing new board members, or even just as you appoint the first few board members, consider what skills they bring to the table and how they can best aid your company’s success. If there are gaps that the current management team or founders of the company have, a board of directors can help fill knowledge and skills gaps. For example, if the founders of a company are technical, they may want to build an advisory board of directors with go-to-market experts, revenue leaders, and financial advisors to ensure that the business decisions are made in conjunction with the great product evolution or development taking place. On the flip side, if a company is expanding into a new industry or adding a product line, an expert in that product field or industry may be a crucial knowledge gap to fill with a board seat.

Prioritize Diverse Perspectives

The best way to make sure your business actually grows from implementing a board and making forward-thinking decisions as a board is to avoid an echo chamber. An echo chamber refers to the same ideas or thoughts being “Echoed” back many times over. Often, it’s easy to be drawn to like-minded leaders or partners you’ve worked within the past when selecting board members. However, think more about the qualities and traits and perspectives the management members or already selected members bring to the table. Then try and find a completely opposite perspective or experience (that still helps your business). Avoiding an echo chamber will ensure all perspectives and sides of an idea are considered when making a decision and avoid obvious mistakes that might be made if everyone can only see one direction clearly.

Onboard Your Directors

Plain and simple, onboard your Board of Directors. Just as you would likely build out a comprehensive onboarding plan for your new employees so they have everything they need to do their job, the Board of Directors are no different. Provide a detailed, comprehensive, and repeatable path for onboarding for your Directors. This will ensure everyone is on the same page and has a clear understanding of the “why” that brings them to the table for your company each and every day.

Regularly Evaluate Your Board

If the board type and structure is set, all your Directors are onboarded, and you have your Board up and running, don’t stop thinking about what your Board’s ideal state looks like. Make quarterly and annual evaluations a habit with your Board to ensure that all members are continuously able (and willing) to serve in their Board role at full capacity. This ensures that your Board remains a valuable part of your business’s strategy and success.

Potential Obstacles to Your Board’s Success (and Solutions)

Despite taking all the steps to build a strong Board of Directors, be aware of potential obstacles to your board’s success.

Too many like-Minded Members

When building your board, especially early on, the board may be small. Between management members and investor or industry expert appointees, you always run the risk of having too many like minded members on the board, preventing any real change or growth to be done. The best solution to avoiding this potential obstacles is to be really intentional when building your board to diversity the perspectives represented and to set clear term limits for your board. That way, even if after working to select members with diverse perspectives, there is a second safety net in place to ensure that after a set number of time, board members will be interchanged to bring in even more perspectives and prevent a like-minded board from forming.

Conflicts of Interest

Another common obstacle many Boards of Directors face is a conflict of interest among board members. This could be due to too much management representation on the board or possibly too many friends and family represented on the board as shareholders. A solution on the management side is to ensure there is a cap on how many management members are represented at any one time on the board. This limit will prevent the management perspective from taking over. Similarly, term limits, or voting rules around stakeholder involvement can help ensure that decisions are made fairly and not just in the interest of the individual board member.

Let Visible Help

A Board of Directors can be game-changing for your business and completely shape the strategic direction to take a company public or through other favorable business outcomes. Once your Board is up and running, it’s important to ensure communications to the Board are seamless and clear. Learn more about keeping your investors updated with Visible here.

founders

Fundraising

Reporting

How to Create FOMO During a Fundraise with Elizabeth Yin of Hustle Fund

On episode 3, season 2 of the Founders Forward Podcast, we welcome Elizabeth Yin. Elizabeth is the founder of Hustle Fund, a venture fund for “hilariously-early founders.”

About Elizabeth

As a past founder and current investor (and a founder favorite Twitter follow), Elizabeth knows what it takes to successfully raise a round of venture capital. Elizabeth breaks down how founders can leverage tranches, raising from small funds and angels, and shares other tactical tips to knock out your seed round.

Our CEO, Mike Preuss, had the opportunity to sit down and chat with Elizabeth. You can give the full episode a listen below:

What You Can Expect to Learn from Elizabeth

How to raise capital from angels

How small checks can lead to big checks

How tranches can be an effective way to raise capital

How tranches and meeting cadence can create FOMO

Why you should have a 5 slide deck

What changes between a Seed and Series A round

How to get the attention of an investor via cold email

Related Resources

Elizabeth’s Twitter

Hustle Fund’s Connect Profile

AngelSquad by Hustle Fund

founders

Fundraising

Reporting

Customer Stories

Creating Momentum in Your Fundraise with Brett Brohl

On episode 2, season 2 of the Founders Forward Podcast, we welcome Brett Brohl of Bread & Butter Ventures. Brett is the Managing Director of Bread & Butter Ventures as well as the Managing Director of the Techstars Farm to Fork Accelerator.

About Brett

As a past founder and current investor, Brett has a wealth of knowledge on how founders can best create momentum during a fundraise. Give Brett a listen as he walks us through best practices to build out a fundraising process.

Our CEO, Mike Preuss, had the opportunity to sit down and chat with Brett. You can give the full episode a listen below (or in any of your favorite podcast apps).

What You Can Expect to Learn from Brett

How to determine if VC is right for your business

How much time you should allocate for a raise

How to model financials for a fundraise

How to leverage investor Updates to speed up a fundraise

Why you should send a 4 slide pitch deck before a meeting

How you should think about moving investors through your funnel

Related Resources

Brett’s Twitter

Brett’s Fundraise Faster Video Series

Troy Henikoff Financial Modeling Series

The Bread & Butter Investor Update Template

Bread & Butter’s Profile on Visible Connect, our investor database

founders

Fundraising

Reporting

The Supply & Demand of VC with Kenn So of Shasta Ventures

On the first episode of season 2 of the Founders Forward Podcast, we welcome Kenn So of Shasta Ventures.

About Kenn

Kenn is an associate at Shasta and invests in B2B enterprise software companies (with a personal focus on Machine Learning).

Kenn joins the Founders Forward to break down the trends taking place that are influencing company valuations. We also dig into how founders can leverage investor updates and cold email to create momentum in a fundraising process.

Our CEO, Mike Preuss, had the opportunity to sit down and chat with Kenn. You can give the full episode a listen below (or in any of your favorite podcast apps).

What You Can Expect to Learn from Kenn

Why founders should take the time to pitch associates

The supply & demand of venture capital that are impacting valuations

Why the emergence of “mega-funds” is changing the VC landscape

The risk of raising at too high of a valuation

How to create momentum in a fundraising process using an email newsletter

What he likes to see in a cold email from a founder

Related Resources

Kenn’s Book, “Breaking into Early-Stage VC“

Kenn So on Tech Valuations

Kenn’s LinkedIn

investors

Reporting

Metrics and data

The Best Practices for VC Portfolio Data Collection

As more capital flows into venture as an asset class, investors are increasingly competing for LP dollars and space on the cap table from the best founders they work with.

Gone are the days when capital is enough of a differentiator for a VC fund to get on a hot startup’s cap table. Considering the average VC + Founder relationship is 8-10 years (longer than the average marriage in the US) — founders are beginning to look for a true partner out of a VC fund.

In order for a VC fund or emerging fund manager to stand out among other funds, they need to have the data and systems in place.

LPs have increasingly higher expectations for fund performance while founders have increasingly higher expectations for VC funds.

About this Report

The goal of this report is to break down the best practices we see hundreds of VC use to collect and share their portfolio data. We outline best practices related to:

Market Data Overview

Timing of Data Requests

Number of Metrics to Collect

Most Common Metrics

The Founder Experience

Qualitative Questions

Minimum Viable Data Request

Company Success = Fund Success

Venture capital funds are only as successful as their portfolio companies. There are few people who have been in a founder’s shoes and can help them navigate the challenges they are facing. However, investors are in a unique position as they’ve likely seen many portfolio companies and potential investments face the same challenges.

In order to best help portfolio companies, investors need to have a strategy in place to collect both qualitative and quantitative data from their portfolio companies.

Collecting a few KPIs and company asks is a great place to start (more on this later in the report). At the same time, there is a balance between helping and being a burden on a portfolio company.

Download our report to learn some simple best practices so you can collect the data you need without burdening your portfolio companies

founders

Fundraising

Hiring & Talent

Reporting

Operations

Metrics and data

Our 7 Favorite Quotes from the Founders Forward Podcast

In 2020 we launched the Founders Forward Podcast. The goal of the podcast is to enable founders to learn from their peers and leaders that have been there before. Over the last 7 weeks our CEO, Mike Preuss, has interviewed a different founder or startup leader every week.

Related Resource: 11 Venture Capital Podcasts You Need to Check Out

Here are some of our favorite quotes and takeaways from the first 7 interviews:

Lindsay Tjepkema, Founder of Casted

Our first episode of the Founders Forward was with Lindsay Tjepkema. Considering she is a podcasting expert, we figured there could not be a better first guest. We chat all things podcasting and alternative media types. However one of the tidbits we found most interesting was Lindsay’s outlook on venture fundraising. Oftentimes fundraising can be a frustrating journey but Lindsay views the process as an opportunity to promote her business and tell her company’s story. Give the full episode a listen here.

Amanda Goetz, Founder of House of Wise

House of Wise is Amanda’s second go as a startup founder. However things are no less difficult than her first time around. Her first journey was spent worrying about legal aspects and the basics of getting her business running. That was easy with House of Wise but she has faced new challenges (and opportunities) during her second journey. Give the full episode a listen here.

Jeff Kahn, Founder of Rise Science

Jeff has 10 years of sleep science experience and research. Before starting Rise Science Jeff spent time publishing academic articles and supporting world-class athletes and teams with better sleep. Jeff Kahn is a true expert in all things sleep. During our interview with Jeff, we chatted about how sleep can improve a founder’s leadership skills and productivity. Give the full episode a listen here.

Aishetu Dozie, Founder of Bossy Cosmetics

Aishetu Dozie started her career in banking and eventually made the transition to starting a cosmetics company. Just like any founder, her first time journey has been full of highs and lows. Aishetu, like many founders and leaders, has struggled with imposter syndrome. We love her thoughts below on how she has tackled imposter syndrome. Give the full episode a listen here.

Kyle Poyar, Partner at OpenView Ventures

OpenView Ventures is credited with coining the term “Product-Led Growth.” As Kyle and the team at OpenView continue to help SaaS companies grow and become market leaders he has seen it all. From the early days of defining PLG and the impact of COVID-19 Kyle is full of first-hand stories and the data to back it up. Check out how Kyle defines and thinks about PLG below. Give the full episode a listen here.

Yin Wu, Founder of Pulley

Yin Wu has been through Y Combinator 3 times and has successfully exited 2 companies. Over the course of her founder journey it is safe to say that she has spent a good amount of time fundraising and chatting with investors. Yin likes to bucket investors into 3 categories to structure who she should be chatting with and raising from. Give the full episode a listen here.

Cheryl Campos, Head of Venture Growth at Republic

Over the past 3 years, the funding options for startups have continued to transform. Over her 3 years at Republic, Cheryl has watched as the market has changed and crowdfunding has become a more viable option. Check out Cheryl’s thoughts on the new funding options below. Give the full episode a listen here.

We have plenty of new episodes recorded and ready to share in 2021. To stay up-to-date with the Founders Forward Podcast, subscribe here.

founders

Fundraising

Reporting

What is a Cap Table & Why is it Important for Your Startup

What is a cap table (i.e. capitalization table)?

“Cap Tables” or capitalization tables are a critical term to understand for any startup founder or aspiring founder. But what is a cap table and why is it important? At the core, a capitalization or cap table is a table or spreadsheet that lays out the equity capitalization for the company. The equity capitalization is the total value of all the shares of the company and the breakdown of how those shares are divided. A cap table is an intricate breakdown of the shares value, holders, and projections. The cap table typically includes specifics of a company’s equity ownership capital such as common and preferred equity shares, warrants, and any convertible equity.

Why is a cap table important for startups?

Cap tables are important for startups for a variety of reasons. It is fundamental for a founder to understand the full scope of a cap table and why they are so important to execute. Cap tables are important because overall they illustrate the health of a startup for investors.

Ownership Breakdown

Founders need to be aware at all times of what their cap table means for ownership of their company. Understanding ownership is critical as the company grows and develops. Cap tables tell investors who owns what part of a company. Current investors want to see who has control. They also want the ability to forecast potential payouts and dilution under specific scenarios based on the ownership split. The breakdown of ownership in a startup can overall affect the value of the company for future fundraising rounds as well as who needs to be at the table for certain critical company decisions.

Related Resource:

How to Fairly Split Startup Equity with Founders

Understanding Contributed Equity: A Key to Startup Financing

Value Tracking

An up-to-date and detailed cap table is important for tracking the value of a startup over time. Beyond current investors and founders understanding the value of a growing startup, employees find cap tables useful as well. A detailed, well-kept cap table is helpful for employees to access if they have options or equity stakes in the startup they work for. Offering equity is an appealing way to draw in top talent at leading startups. The ability to track value real-time by viewing a cap table is an important component of the value of a cap table.

Fundraising

In addition to current investors utilizing a cap table for forecasting and dilution predictions for different outcomes on their investments, potential investors and future fundraising can also be affected by cap tables. Potential investors can evaluate how much control and leverage could be maintained during negotiations by viewing a cap table. Historical insight provided in a cap table can affect negotiating current valuation for new funding raises. Additionally, an existing shareholder can easily determine what percentage of the company to give to the new investors in exchange for the capital contributed.

Potential Audits

In the event of an audit on a startup, a well-managed cap can allow your legal team to present your company’s history and holdings with accurate and well-organized information via a cap table. In general, a well-organized and well-maintained cap table is critical for the health and growth of a company across all financial situations.

What does a cap table look like?

Cap Tables are built out on two axis’. Typically, cap tables include a list of names or groups associated with the startup including founders, investors and common share stakeholders along one of the axis. Along the other axis the items that the various stakeholders and owners own. These items include things like types of securities, how many of these securities they own, when they invested in the company, and the percentage of company owned. Carta provides a good example of a Cap Table below:

How do you make a cap table?

Cap tables can be created and managed in a variety of ways. Typically it is common for new startup founders to build their initial cap table in a spreadsheet. However, as your startup grows and the valuation and stakeholders get more involved and complex, simple cap table design in a program like excel won’t work.

Some companies will use a tool, such as CapShare or Carta to build and manage their cap tables. These tools are typically more dynamic and less manual than managing via excel. They can be easier to utilize to share out and circulate with employees and investors.

In other scenarios, it might make the most sense to outsource the production and management of a cap table. When founders choose to self-manage their own cap table they are susceptible to risks. Some of these risks include miscalculating valuations which can lead to giving up too much equity and over-diluting shares in new investment rounds. Additionally, there might be tax consequences or legal issues that come up from mis-management of a cap table. By outsourcing the production and management of a cap table. Typically this management is outsourced to a legal team to ensure accuracy and compliance. Outsourcing is more expensive than managing with a software but can be much less expensive the cost of major mistakes or miscalculation of value.

How to use a cap table?

When using a cap table, it’s important to understand the following formulas:

Post-Money Valuation = Pre-Money Valuation + Total Investment Amount

Price-Per-Share = Pre-Money Valuation / Pre-Money Shares

Post-Money Shares = Post Money Valuation/ Price-Per-Share

Investor Percent Ownership = Investor Shares / Post-Money Shares

These formulas are essentially what will be laid out in a cap table so understanding them is crucial. These formulas can also be used to update the cap table as it grows more complex via different significant financial rounds.

The more investment rounds or other significant financial changes on the table, the more complex the cap table gets. This breakdown essentially showcases the additional steps and participants who are stakeholders in the startup.

Founders round – this is the simplest version of the cap table and will typically showcase the simple split of equity between the founders of the company.

Seed round – this introduces investors to the table who now own a portion of the company along with the founders and have given cash to the startup altering the overall value.

Options pool round – when options are provided for new employees, this changes the value and breakdown of the company as represented by the cap table. Overtime, as more employees are hired and more options are granted, the more complex the cap table gets.

VC round(s) – With any additional funding rounds taken on by the startup, the valuation drastically changes as does the list of stakeholders on the cap table.

All of these events or rounds are significant and will change the breakdown and complexity of the cap table.

How do you keep a cap table updated?

With the array of cap table management tools on the market updating and keeping tabs on your cap table is easier than ever before. Generally founders need to stay on top of their cap table management. If you raise a new round, offer new employee grants, terminate an employee, etc. you need to make the changes as soon as possible to avoid future headaches.

If you put off updating your cap table in real time it could end up being a costly mistake as you need a lawyer to update and correct the table.

We highly recommend using software to manage and update your cap table to make your life as easy as possible. There are countless options but we recommend using Pulley. You can learn more about cap table management (and Pulley) in our Founders Forward Podcast with Pulley CEO and Founder, Yin Wu, here.

Cap table examples/templates

Instead of starting from scratch, many founders will use a template to build out a cap table. Alexander Jarvis provides an easy cap table template here.

S3 Ventures offers a template in Excel that they recommend for their portfolio companies.

Manage Your Stakeholders with Visible

Manage relationships with your investors and other stakeholders using Visible. Centralize your key data, share updates with investors, and track your interactions with current (and potential) investors all from one place. Learn more and try Visible for free here.

founders

Fundraising

Reporting

RSUs vs RSAs: What’s the difference?

What is a restricted stock unit?

Restricted Stock Units or RSUs are forms of compensation issued to employees by an employer founder. This compensation is issued in restricted company shares. Shares are restricted because their value is limited by a vesting plan. After a set amount of time laid out in a vesting plan occurs, a certain amount of shares becomes accessible and valuable. RSUs give employees interest in a company but will not be worth their full value until the full vesting period is complete. RSUs will always have value due to their underlying shares.

What is a restricted stock award?

Restricted Stock Awards or RSA’s are given to the employee on the day they are granted. They do not have to be earned via a vesting schedule like RSUs do. The employee “owns” the stock associated with the RSA on the grant date. However, they may still have to purchase them, depending on the nature of the offer. This purchase contingency is why RSAs are considered “restricted stock”.

RSUs vs RSAs for startups

Overall, restricted stock in the form of RSUs or RSAs can be a value-add for startups and a great way to incentivize talent employees to join the team. RSUs are not purchased at grant date but instead have a timed vesting period as well as other vesting conditions before they are owned outright. RSAs are purchased on the grant date but still typically have time-based vesting conditions. Unvested RSUs are given up when an employee is terminated and RSAs are available for repurchase when an employee is terminated. RSAs are typically granted to early employees before funding rounds with additional equity payouts and RSUs are typically granted to employees after funding is taken on.

What the differences are important to understand

RSUs and RSAs are two common terms to understand in the startup landscape. RSU stands for “Restricted Stock Unit” and RSA stands for “Restricted Stock Award”. Understanding the difference is key when building and operating a startup.

While both RSUs and RSAs are forms of restricted stock, they are different and serve different purposes. In general, restricted stock is owned from the day it is issued and does not need to be purchased. However, because it is restricted, it needs to be earned.

How do restricted stock units work?

RSUs became popular in the early 2000s after a variety of executive fraud scandals occurred across the market. With it’s vesting limitations, RSUs have become a popular option for compensating leadership and early employees without the risk of providing full stock upfront.

RSUs give an employee interest in company stock but they have no tangible value until vesting is complete and typically vesting plans are staggered so that only a certain percentage of shares vest at a time. For example, if an employee has a 4 year vesting period with a 1 year cliff, they would only walk away with 25% of their promised shares after a year of employment (or none if they leave or are terminated prior). RSUS are also structured with limits in case termination occurs that can override vesting or cliff rules. The restricted stock units are assigned a fair market value when they vest. When RSUs finally vest, they are considered income, and a portion of the shares is withheld to pay income taxes. When the employee receives the remaining shares and can sell them. If an employee is terminated, they keep any of their vested shares but the company can purchase back the unvested shares.

Like any potential compensation option, RSUs have pros and cons to their structure and offering.

Some Pros of offering RSUs include:

Long Term Incentive – because of the standard vesting period of 4 years, generous RSU packages can be helpful in incentivizing top talent to stick around longer, put in more effort to grow the company, to ultimately claim their full offering of stock at the highest possible value.

Low-Impact: The admin work and back-end management of RSUs is minimal compared to other, more complicated stock incentive plans. RSUs also allow a company to defer issuing shares until the vesting schedule is complete. This helps delay the dilution of its shares.

Related Resource: Everything You Should Know About Diluting Shares

Some Cons of offering RSUs include:

No Dividends: Because actual shares are not allocated, RSUs don’t provide dividends to the stock holders. However this means that the employer issuing the RSUs needs to pay dividends in an escrow account that can help offset withholding taxes or be reinvested. This is something to keep in mind as a potential founder offering RSUs.

Income Restrictions: RSUs aren’t taxable until they vest. So employees can’t pay taxes before vesting as the IRS doesn’t consider unvested RSUs to be tangible property.

Shareholder Voting Rights: RSUs don’t grant the shareholder voting rights or input into the company until they are fully vested.

How do restricted stock awards work?

Restricted Stock Award shares are given to the employee on the day they are granted. While RSUs are more commonly awarded to general employees, RSAs are more common with early employees at a startup before the first round of equity financing. Instead of a timed out vesting period that portions out the stock like in an RSU, an RSA is the lump sum awarded on one date (although that may still be time-based).

Vesting still applies in a different way to RSAs. Vesting only impacts a receivers RSAs if they are terminated or leave the company allowing the company to potentially purchase back the shares. The vesting is less about the employee owning the stock as the RSA is owned but about the ability to retain what is owned. However, there are usually time-based rules associated with RSAs so that the shares may expire if certain requirements, specifically financial requirements, aren’t reached. Most companies have vesting schedules in place to prevent individuals from joining a company, receiving their RSA award, and leaving immediately.

Most RSA pros and cons are fairly similar to RSUs as RSAs are simply another form of restricted stock.

How are restricted stock units taxed?

With restricted stock, it’s important to consider two types of taxes: regular income tax and capital gains tax. Taxing on restricted stock is complex but the basic underlying factor of income still applies – anything that a company pays an employee is taxable.

For RSUs, regular income taxes are paid when the recipient shares vest.

How are restricted stock awards taxed?

For RSAs, the receiver has to pay for them outright so when the vest date rolls around there are no additional taxes to pay on the shares themselves unless they change value. The RSA receiver will only need to pay taxes on the gains in value of the shares. The tax on gains between grant date and vesting will be income tax. The tax on gains between vesting and sale of those shares will be capital gains tax.

An election called the 83(b) election can be selected on a tax form which means the recipient can pay all their ordinary income tax upfront. The 83(b) election is eligible for RSAs not RSUs.

founders

Reporting

5 Takeaways From Our CEO On The Stride 2 Freedom Podcast

Last week, Mike, our CEO, joined Russell Benaroya on Stride Services’ “Stride 2 Freedom Speaker Series,” where every week Russell interviews people who can help you move your business faster. Russell and Stride have been longtime users of Visible & great partners to work with. On this episode, Mike & Russell discuss Visible’s recent developments, the relationship driven nature of venture capital, and why people invest in lines rather than dots. You can listen here.

Related Resource: 11 Venture Capital Podcasts You Need to Check Out

VC is a Relationship Driven Business

Venture capital investments take a long time to reach maturity. In many cases, an investor is “hitching a wagon to you for the next 10+ years.” You need to show that you’re trustworthy and working for the long term to persuade an investor to take a chance on your company.

Good Communication Has a High ROI

At Visible, we like to say that communication saves startups, but it can also help startups get off the ground. Mike mentions that it’s rare that an investor will write a check based on a single interaction. However, investors are able to see your growth if you have past investor updates that you can share to show your progress over time. They’ll also feel good about your level of transparency, and believe that you’ll keep them in the loop too if they decide to invest.

Relationships Are Built On Lines, Not Dots

You need to show consistent improvement over time when fundraising. It’s impossible to build an accurate judgement of a business or an individual with only a handful of scattered data points. Long term relationships are built through consistency of character, and long term businesses are built by consistent iteration and effort. You can impress people by showing how you’ve developed over time, regardless of where you currently stand. It’s crucial to focus on lines, rather than dots when building investor relationships.

Good Leaders Care About the Team

What does Mike wish people asked him more about? The team. Startups are built by teams, not just founders. When asked about how we built our newsletter to nearly 20,000 subscribers, Mike recognized that the credit belongs to Matt (who runs marketing here at Visible), rather than himself. The more that a founder can celebrate a team & lead effectively, the better they will perform in the long term.

The Startup Ecosystem is Increasingly Global

While Silicon Valley will likely remain the primary startup hub in the US for the foreseeable future, the emergence of new startup ecosystems around the world are beginning to attract new founders and investors. At Visible, we’re fortunate to help thriving entrepreneurs from around the world, and Mike has been personally exposed to many startup ecosystems around the US. With the rise of remote work during the pandemic, founders are re-evaluating whether or not they need to remain in the traditional startup cities. As a globally distributed team ourselves, we can verify that A+ talent exists in every corner of the world. Founders everywhere are waking up to this trend – expect to see more startups founded worldwide, not just in northern California.

founders

Reporting

Our Guide to Investor Updates

It’s simple – founders that send regular updates to stakeholders are more likely to get funding. It’s never been easier to manage your communications.

investors

Reporting

Operations

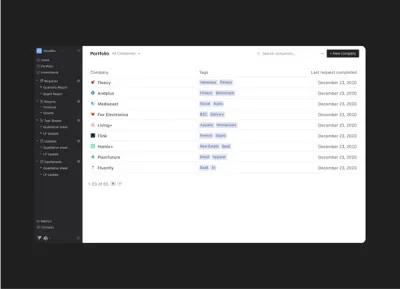

Best Practices for Portfolio Management

Getting regular, high quality, and actionable data from portfolio companies is important. It allows you to make better decisions, support your portfolio, share insights with portfolio company founders, report to LPs and more.

This practice should also be highly valuable for founders. They should be able to share wins, challenges and get help from you, their stakeholder. It should only take them 3 minutes to complete (if not, either something may be wrong with the request or structurally wrong with the company).

Below are some best practices to make sure you get:

Timely information (e.g. 100% completion)

Structured data(comparing apples to apples)

Actionable insights (how can we help companies)

Timing & Cadence

Same time every period

Set the expectation that you will be sending a request the same time every month. e.g. your request will be due the 20th post month or quarter end. Don’t randomly switch between the 10th, the 30th, etc. Founders will not have an expectation and know they can submit whenever they want.

Luckily Visible makes this easy for you. You’ll be to set you schedule and we take care of all emails, due dates and reminders.

Appropriate Cadence

We recommend the following cadences. This is 100% customizable as every fund is different.

Weekly – Accelerators in Cohort

Monthly – Pre-Seed, Seed, Series A

Quarterly – Series B & later

Request Content

Less is more.

Don’t send a request asking for every metric under the sun. Only get the information you truly need. If you are truly providing value back to the founders, then start small, get a rhythm and expand the data.

Metrics

5-15 Metrics.

Depending how closely you work with companies, ask for 5-15 metrics and no more.

Use a metric description!

If you are asking for Burn and don’t provide context, you might get 15 different variations. Should it be negative? Should it be trailing 3 months or current month? Should it include financing? Be descriptive about what you want. **Here is our Metric Library** that has some helpful descriptions.

Qualitative Info

How can you help?

Always make sure to use a qualitative section to see how you can best help the portfolio. Also let the founder share their wins and challenges if it makes sense!

Rollout

Let your current (and new) portfolio companies know to expect a regular request from you and what to expect.

Intro Template

Feel free to use our Intro Copy Template if you need some inspiration.

Custom Domain

All of your requests will come from you. However, with Visible you can fully white label the request emails so they come from your email and domain.

Unlock Your Investor Relationships. Try Visible for Free for 14 Days.

Start your free trial