Blog

Reporting

Resources to help level up your investor reporting.

All

Fundraising Metrics and data Product Updates Operations Hiring & Talent Reporting Customer Stories

investors

Metrics and data

Reporting

Streamlining Portfolio Data Collection and Analysis Across the VC Firm

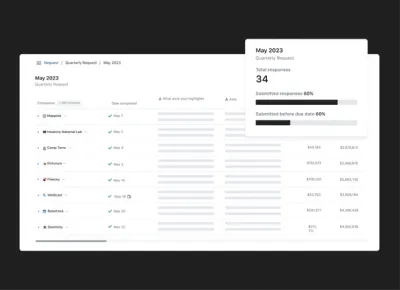

Many Venture Capital firms struggle to efficiently collect updates from their portfolio companies and turn the data into meaningful insights for their firm and Limited Partners. It’s usually a painful process consisting of messy Google Sheets or Excel file templates being sent to companies. Then, someone at the VC firm is responsible for the painful task of tracking down companies and convincing them to send the metric template back to the investor. The end result is typically an unreliable master sheet that isn’t accessible or easy to digest for the rest of the firm.

Visible has helped over 350+ VC firms streamline the way they collect, analyze, and report on their portfolio and fund performance. Keep reading to learn how.

Streamlining Portfolio Data Collection

To set up a more efficient portfolio data collection process at your firm make sure you:

Don't require companies to manage another login

Visible’s data Requests are delivered directly to your companies’ email inboxes and the secure-linked base form ensures there is no friction in the data-sharing process.

Maintain founder privacy

Visible supports over 3.5k founders on our platform and the consistent feedback we hear is founders do not want their investors to have direct access to their data sources. Founders prefer to have control over what and when their data is shared with investors.

Customize which information you request from companies

Visible allows investors to create any custom metric, qualitative question, yes/no response, multiple choice, and more. This provides investors with the flexibility to use Visible for more than just financial reporting but also impact or diversity reporting and end-of-year audit preparation.

Related resource: Portfolio Monitoring Tips for Venture Capital Investors

Related resource: Which Metrics Should I Collect from My Portfolio Companies

Easy Ways to Analyze VC Portfolio Data

While having up-to-date, accurate investment data is important, being able to extract and communicate insights about your portfolio data is when it really becomes valuable. Visible supports three different types of dashboards to help you analyze your portfolio data more easily.

Flexible portfolio company dashboards — Visualize KPI’s by choosing from 9 different chart types and combine with rich text and company properties. These dashboards are a great fit to help facilitate more robust internal portfolio review meetings.

Portfolio metric dashboards — This dashboard allows you to compare performance across your entire portfolio and easily identify your top performers and the companies who may need additional support.

Fund analytics dashboards — This flexible dashboard lets investors control how they want to visualize and analyze their fund performance metrics. Choose from over 30+ fund metrics and auto calculated insights and easily add them to your shareable dashboard.

View an example of all three types of dashboards by downloading the resource below.

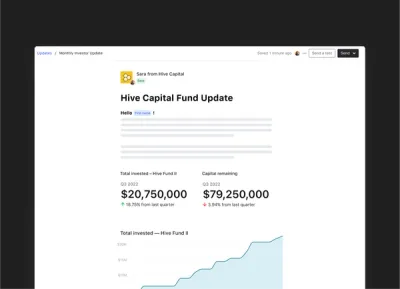

Sharing Portfolio Updates with Limited Partners

It’s important to remember that while Limited Partners are primarily focused on financial returns they also care about insights. VC firms who empower their Limited Partners with updates about sector trends and high-level insight into portfolio company performance are setting themselves up to be both trusted and valuable long-term partners to their investors.

LP Update Template Library — Visible makes it easy for firms to make engaging communication with Limited Partners a habit by providing free and open-source Update templates. Want to feature your LP Update template in out library? Get in touch!

Tear Sheets — Tear Sheets or One Pagers can be a great way to provide high-level updates about portfolio companies to your LPs. Visible’s tear sheet template solution helps VC firms create reporting with ease by merging information and data into beautiful charts that are automatically kept up to date.

View Tear Sheet examples to inspire your next reporting.

Related resource: Tear Sheets 101 (and how to build one in Visible)

Visible supports 400+ funds around the world streamline the portfolio data collection, analysis, and reporting process.

investors

Customer Stories

Reporting

[Webinar Recording] Leveraging portfolio analysis to improve your fund’s IRR

A recent poll of VCs shows that some of the primary reasons investors collect financial data from portfolio companies is to improve their post-investment support (66%) and inform future investment decisions (44%). To do this well, investors need to be able to analyze their portfolio company data through an advanced financial lens so they can extract actionable insights that lead to improved fund performance.

We recently sat down for a conversation on Leveraging Portfolio Analysis to Improve your Fund’s IRR with Kristian Marquez, CFA. Kristian is the CEO of FinStrat Management and a Chartered Financial Analyst (CFA) charterholder since 2004.

The webinar was designed for people working in Venture Capital who want to level up the way they understand and analyze their portfolio companies’ financial performance data.

Topics Discussed:

The WHY behind surfacing portfolio insights

Where to find benchmark data and how to use it

Top 4 performance indicators, what they mean, and how to calculate them

Using dashboards in Visible to evaluate portfolio company performance

Tips for moving from analysis to action

investors

Reporting

[Webinar Recording] VC Portfolio Data Collection Best Practices

Collecting updates from portfolio companies on a regular basis is an important part of running smooth operations at a VC firm. Well-organized, accurate, up-to-date portfolio data helps investors provide better support to companies, make data-informed investment decisions, streamline the audit process, demonstrate credibility during the fundraising process, and more.

However, collecting data from portfolio companies on a regular basis can also be a time-consuming, arduous process, especially if you’re not implementing best practices.

On Tuesday, June 20th Visible held a product webinar covering tips for streamlining the reporting process for you and your portfolio companies.

This webinar is designed for any VC looking to upskill their portfolio monitoring processes. Current Visible customers will benefit from a deep dive into recent product updates related to Visible’s Request feature.

Topics Discussed:

The top 6 most common metrics to collect from companies

How to collect budgets and actuals in Visible

Using formulas so you can ask for less data

[Product Walk-through] Highlighting recent product updates

Reviewing examples of different types of Portfolio requests

investors

Customer Stories

Reporting

Case Study: How Render Capital Uses Visible to Streamline Fund Reporting

Render Capital is a $30M early-stage VC fund with offices in Kentucky and Indiana. Led by Patrick Henshaw, Render has invested in 50+ companies as a part of its mission to create a robust and thriving regional economy where entrepreneurs see the Midwest and South as a place they can find appropriate risk capital necessary for them to start and grow.

For this case study, Visible interviewed Render Capital’s Operating Partner Mike Shepard.

Customer Story: How Render Capital Uses Visible to Streamline Fund Reporting

Watch the video below to learn why Render chose Visible to streamline their portfolio monitoring and reporting processes.

Prefer to read? Keep scrolling to read a paraphrased summary of Mike’s responses.

Q: How were you collecting data prior to using Visible?

Prior to Visible, Render was doing very little to collect data from companies because it was too time-consuming to do it via email and the process wasn’t very organized.

Q: What factors led you to choosing Visible?

We looked at other software to help with our fund management and the options seemed cumbersome, the relationships were tricky, and it seemed like it was actually going to be more work. I wanted to find a solution that let me pair our fund management alongside our own metrics so we could do our own reporting by creating dashboards and sharing those with LPs. We also liked that Visible helped collect reporting from our companies on a regular basis.

Q: What was the onboarding with Visible like?

I filled out a spreadsheet with our company and investment data. I prefer to be hands-on so the next step was just figuring out how to set up my own LP Update templates and reports. Visible was available to answer all my questions and the team was open to our feedback.

“It feels like we’re your only customer which is what you’re supposed to do.”

– Mike Shephard, Operating Partner at Render Capital

Q: What has been the result of using Visible

The results have been great. I created an LP Update template which we consider a marketing extension of our brand. To get this to look nice outside of Visible, in Excel, would have taken me a lot of time. I can use the template I created in Visible over and over again and it automatically updates. Our LPs are also really happy with the direction of our reporting and what we’re producing. We are getting our LPs the information that they want and need in a format that they can easily digest.

Over 350+ VC funds are using Visible to streamline their portfolio monitoring and reporting.

investors

Reporting

Metrics and data

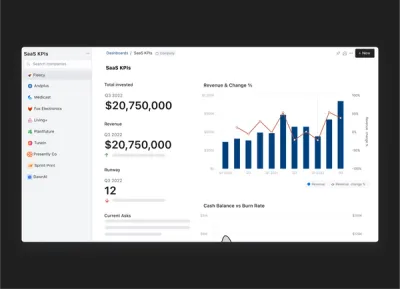

Flexible Dashboards for Venture Capital Investors (with examples)

As a venture capital investor, it’s critical to maintain accurate, up-to-date information about your portfolio companies and investment data. This helps investors make data-informed investment decisions, provide better portfolio support, fulfill audit requirements with relative ease, and not to mention, impress LPs.

What’s even better than just having your data well-organized and easy to find, is when investors can seamlessly turn that data into meaningful insights that are easy to share with internal team members and stakeholders.

Below we describe three different dashboard types supported in Visible that help investors surface and communicate important updates about their portfolio.

Flexible Dashboards for Internal Portfolio Reviews

Flexible dashboards in Visible allow investors to integrate metric data, investment data, and properties directly into a dashboard. The flexible grid layout means investors have control over how they want to visualize and communicate updates to their team.

Investors commonly use these dashboards to facilitate internal portfolio review meetings which keeps their team up to date and engaged about important updates across the portfolio.

View flexible dashboard examples in the guide below.

Fund Performance Dashboards for Communicating with LPs

Visible allows investors to track, visualize, and share key fund performance metrics. Investors can choose from 14+ different chart types and use custom colors to incorporate their branding into their dashboards.

The fund metrics supported in Visible include:

TVPI

DPI

RVPI

MOIC

IRR

Unrealized and realized FMV

Total Invested

Capital Called

and more.

Learn about the 30+ fund metrics supported in Visible.

Related resource: VC Fund Performance Metrics 101

View a Fund Performance Dashboard example in the guide below.

Portfolio Metric Dashboards for Cross-Portfolio Analysis

As a venture capital portfolio grows, it’s helpful for investors to be able to pull quick insights across all their companies. Visible’s Portfolio Metric Dashboards let investors compare performance across the entire portfolio for a single metric. This view can be filtered by a custom segment and time period. Visible also automatically calculates quick insights such as:

Total

Min

Max

Median

Quartiles

View a Portfolio Metric Dashboard in the guide below.

Visible’s dashboards give investors control over how they want to track and visualize their portfolio KPIs and investment data. Learn more about Visible.

investors

Product Updates

Reporting

Unlocking Venture Capital Portfolio Insights with Dashboards

If your portfolio data is patched together in an excel file with questionable version control or is buried in a slide deck prepared six months ago, your team is likely missing the opportunity to take action on important portfolio insights.

Up-to-date, accurate portfolio insights help venture capital investors:

Provide better portfolio support

Make data-driven investment decisions

Validate markups and markdowns during evaluation exercises or an audit

Demonstrate traction to LPs while fundraising for future funds

…but only if the insights are accessible.

Visible’s dashboards help venture capital investors visualize and explain the journey companies are on in a way that actually resonates.

Learn more about leveraging dashboards in Visible.

About the Guide

This guide demonstrates how venture capital investors can turn their portfolio data into actionable, accessible insights. The guide also includes examples of three different flexible dashboard types in Visible.

Topics covered include:

Portfolio data collection best practices

Creating dashboards for internal portfolio reviews (Flexible dashboards)

Identifying cross-portfolio insights (Portfolio metric dashboards)

Sharing portfolio insights with Limited Partners (One pagers)

Visible has helped over 350+ venture capital funds streamline the way they collect, analyze, and report on core metrics from their portfolio companies on a regular basis.

founders

Reporting

The Complete Guide to Investor Reporting and Updates

Investor Reporting Meaning & Definition

Put simply, the definition of investor reporting is the act of sharing key qualitative and quantitative data with your financial investors. Investor reporting can look different for different companies, depending on the company stage and vertical. A pre-revenue company may share a light, qualitative investor report, while a publicly traded company is obliged to share an in-depth report covering everything from executive compensation to granular financials. Whether a company is just 2 founders in a garage or 30000 employees spread across the globe, investor reporting is a vital part of running a successful business.

Investor reporting can also take place outside of a physical report. The function of investor reporting, or an investor relations team, also covers board meetings, press conferences, releasing financial data, etc. For a publicly traded company, the meaning of investor reporting involves more regulation and knowledge of government policy. Whereas a startup will communicate directly with their investors, an investor reporting team at a publicly held company primarily deals with analysts who are responsible for providing an opinion to the public on the potential of investment in said company.

At a startup, or privately held company, the meaning of investor reporting slightly changes. Instead of focusing on sharing financial and legal information for the public to make an investment decision, privately held companies often focus on engaging and leveraging their investors. Unlike a publicly held company, a privately held company is not legally obliged to report to their investors. However, the numbers show that companies who have taken on venture capital it is beneficial to practice investor reporting. According to our data, companies that regularly communicate to their current investors are twice as likely to raise follow-on funding.

Outside of the increasing the likelihood of raising follow on funding reporting to your private investors has other benefits. Chances are if you have accepted venture capital, the venture capitalist and partners at the firm can offer you a wealth of knowledge, experience, and introductions. By practicing investor reporting, founders can build a relationship with their investors and increase their chances of receiving help, time, and introductions from their investors.

Related Resource: How to Build a Strong Investor Relations Strategy

Investor Reporting Software

While most startup founders and leaders know they should be sending investor reports, it can often get lost in the shuffle of building a great product, repeatable sales process, and attracting top talent. To help combat this, there are several solutions and products that help relieve the stress of investor reporting and build a professional and repeatable investor reporting process.

The most common investor reporting solution is a simple email update template. These are generally sent on a monthly or quarterly basis and include a recap from the previous period, important company key performance indicators, big wins, losses, and asks for your investors.

Visible Updates are a solution to bring a professional, beautiful, and engaging touch to your investor updates. Visible allows you to connect your key data, build beautiful charts, and add qualitative data to create beautiful investor updates. Send your Visible Investor Updates via email, slack, or PDF. In turn, we’ll provide engagement statistics to see how your investors are interacting with your Updates.

Visible also allows founders to segment different groups of investors and different stakeholders. For example, a founder may want to send a more in-depth investor report to their board members and maybe a liter version to their less engaged investors. Investor reports can also be used as a means to nurture potential investors. No matter how you define investor reporting, it can be a vital—and often overlooked—aspect of building a strong venture-backed business.

Investor Email Templates and Examples

Investor Relations Examples

As mentioned above, investor relations and reporting can take different forms. Investor relations examples vary greatly from public to private companies, and from early stage to growth stage companies. We’ve highlighted a few of our favorite investor relations examples below. For the examples, we’ll share they are generally intended to be sent on a monthly basis. We’ve also created a library of great investor relations examples.

Related Resource: Investor Relationship Management 101: How to Manage Your Startups Interactions with Investors

Monthly Update Email Templates

Our standard startup investor reporting example The standard investor reporting template by the team at Visible. What we have found to be best practices for investor reporting collected from our users and investor thought leaders.

Techstars Minimum Viable Investor Update Email Template In the “Minimum Viable Investor Update”, Jens Lapinski, Former Managing Director of Techstars METRO, lays out 3 items that he finds most useful in his portfolio company updates.

Founder Collective “Fill-in-the-blank” Investor Update Email Template An investor Update template for busy founders put together by the team at Founder Collective. Simply fill out the bolded sections and have your investor Updates out the door in no time.

Jason Calacanis Investor Update Email Template A 10 part monthly update email template put together by famous angel investor, Jason Calacanis. Simply include the sections you have content for and wow your investors with your update.

Kima Ventures Investor Update Email Template A monthly update email template put together by Jean and the team at Kima. Quickly fill in the quantitative and qualitative data Kima finds most useful.

GitLab Investor Update Email Template A 6 part monthly update email template put together by the team at GitLab. Built for investors to quickly read and locate the information that is most relevant to them.

Shoelace: Investor Update Email Template A monthly update email template based off of Reza Khadjavi’s, Founder & CEO of Shoelace, investor update email used to wow investors.

Coding VC: Investor Update Email Template A monthly investor update email template from Leo Polovets, the general partner at Sosa Ventures, consisting of 5 sections that can be repeated on a monthly basis.

Y Combinator Investor Update TemplateA monthly investor update email template from Aaron Harris of Y Combinator focusing on major KPIs and asks for your investors.

Other Monthly Update Email Templates

Outside of regularly sending your investors monthly email templates, founders will also want to send other stakeholders email reports. This can include your team, individual business units, advisors, clients, etc. We’ve highlighted a few of our favorite stakeholder update email templates below:

The CEO Note Template An Update to share information across your company using different methods and styles used by leaders like Marc Benioff, Scott Dorsey, and Kyle Porter.

Fred Wilson: The Weekly Update Email A template based off of Fred Wilson’s Weekly Email intended for founders to share what’s on their mind, what happened the past week, and what’s on the schedule for the upcoming week.

All-Hands Team Update Email Template An Update template intended to share before your next All-Hands meeting or share after to summarize the meeting. Largely based off of Square’s Town Hall meetings and is broken into 3 major categories; The Team, Mission & Goals, and Agenda & Questions.

Pre-Board Meeting Update Email Template A Pre-Board Meeting Update Template that you can share with your board to help you make the most of your meeting time. By sending over a quick packet before your next meeting it will allow everyone to have time to prepare and come ready to discuss the topics that truly matter to the business.

V2MOM Monthly Update Email Template V2MOM is a management process and acronym standing for vision, values, mission, objectives, and measures.

Portfolio Management Software for Investors

While it falls on the shoulders of founders and company operators to report to their investors, it is also important for investors to engage their portfolio companies and transform their portfolio company data into valuable information. A quick reminder from investors to their portfolio companies can help increase the odds of receiving an investor report or data from portfolio companies. Staying on top of portfolio companies allows investors to lend a hand to help the company with their challenges, in turn increasing their portfolio companies’ value.

To help investors stay on top of their portfolio, and report to their own investors, there is portfolio management software for investors. At Visible, we have created our own portfolio management software for investors, Visible for Investors.

Using portfolio management software, investors can easily lend a hand to their companies and turn their data into actionable reports that can be shared and used across the portfolio. In turn, investors can use this to manage their own investors or limited partners. Investor software generally operates like a traditional customer relationship manager with the customer being their portfolio companies and founders.

Our Portfolio Management Software.

Visible for investors is investor software to help stay engaged with your founders right from your pocket. Using portfolio management software be the value-add investor that you want to be. Tap into your experience, network, and resources to jump in and help your investments when you see indicators that they may be struggling.

Managing an entire portfolio can be tough. Using our portfolio management software easily centralize all of your vital information in one place. From sentiment to investment memos, you’ll be able to customize your Visible instance to your needs.

Using automated update request, create your own unique investor report to your firm. Automatically send update requests to your portfolio companies, with scheduled follow-ups, to receive consistent data across your portfolio. Prompt for key metrics, files, operating information and qualitative updates.

Investor Management Software

Everything we build at Visible is focused on the founder. To help complete the investor Update request founder’s can take advantage of our existing investor management software to tap into our learnings and resources. Easily use our integrations and API to automatically fulfill any investor request.

Investor reporting has never been easier with the combination of our investor engagement software and portfolio management software for investors.

What is Investor Relations?

According to the National Investor Relations Institute, “Investor Relations is a strategic management responsibility that is capable of integrating finance, communication, marketing and securities law compliance to enable the most effective two-way communication between a company, the financial community, and other constituencies, which ultimately contributes to a company’s securities achieving fair valuation.”

As we discussed earlier, investor relations can take different forms depending on the owners of the business. Investor relations for a publicly held company will greatly vary than the investor relations for a privately held, venture-backed business. While not required, the benefits of investor relations for a privately held company are instrumental in the growth and health of the company. Sending a simple email update, or creating an investor relations website, allows privately held companies to tap into their investors’ network, experience, knowledge, and ultimately additional capital.

At a publicly traded company investor relations is legally obliged to have an internal investor relations team, meet certain requirements, and have the information audited. Often a larger team, the investor relations department is responsible for hosting an investor relations website for the public to access their key information to gather as much information as possible before investing. According to Investopedia, “IR teams are typically tasked with coordinating shareholder meetings and press conferences, releasing financial data, leading financial analyst briefings, publishing reports to the Securities and Exchange Commission (SEC), and handling the public side of any financial crisis.”

Benefits & Importance of Investor Relations

On the public side, the importance of investor relations is pretty clear. The role is to provide the analyst with vital and required information who in turn who provide public opinion on the company as an investment opportunity. By creating internal audits and becoming the source of truth between all business units. IR can manage an analyst’ expectations in turn influences the overall investment community showing the importance of investor relations in a big way.

On the flip side, we have investor relations for privately held companies. In the total opposite fashion, privately held companies are in no way obliged to release their financials and meet any requirements from their investors. However, the benefits and importance of investor relations for a startup can be monumental in the company’s growth and health. The biggest benefit of investor relations is the likelihood of raising additional capital. Venture-backed businesses who send their investors monthly reports are twice as likely to raise follow on funding. As Jason Calacanis, famous angel investor, puts it; “There is another really awesome reason to keep investors updated: they didn’t give you all of their money — they have more! They want to give you more!”

Another benefit of investor relations? The investors have likely been in the same situation or encountered it with other investments. At the end of the day, an investors job is to make investments that generate returns for their investors. By using investor relations to share bad news, your investors can step in and help get your company back on track with their depth of knowledge, experience, networks, and capital. All in all, the importance of investors relations at a venture-backed company is vital when it comes to attracting additional capital and talent.

Investor Relations Salary and Jobs

Since the Public Company Accounting Reform and Investor Protection Act, was passed in 2002 the marketplace for investor relations jobs has greatly increased. An investor relations manager job can cover different facets of a business, but generally involve supporting the release of financial information, investor reports, and legal diligence.

Investor relations responsibilities are vital to the life of a business from both the legal and operational standpoint. Investor relations jobs are often found as a subset of the companies public relations or finance department. From a legal standpoint, an investor relations manager is responsible for fulfilling legal requirements and financial documentation. Investor relations managers take company financials and data to turn them into compelling data stories that can be shared with analysts and eventually the public. Investor relations managers need to determine what data will affect the public shareholders and present that in an understandable and compelling way. From an internal standpoint, an investor relations manager is responsible for managing crisis and collecting feedback and passing that along to upper management. As CFI puts it, “Communication is also a two-way street; the IR department is also responsible for forwarding input from significant stakeholders of the company to management. During times of crisis (financial or otherwise), the IR department will advise management with a goal to preserve the company’s relationship with its investors, as well as to mitigate any damage to share prices.”

According to Salary.com, an investor relations managers salary typically falls between $100,000 and $140,000. Of course, investor relations salary fluctuates depending on experience, education, certifications, etc. On the flip side, there are also investor relations firms that publicly traded companies can use to take on their investor relations responsibilities. The investor relations salary at a company or at an investor relations firm tend to be in the same range. A couple of popular investor relations firm include, KCSA Strategies, Liolis, and Al Petrie Advisors.

investors

Metrics and data

Reporting

What is Internal Rate of Return (IRR) in Venture Capital

What is IRR in the Context of Venture Capital

Internal rate of return (IRR) for VCs is the expected annualized return a fund will generate based on a series of cash flows over the duration of the fund, which is typically ten years. Unlike fund metrics such as RVPI, TVPI, and DPI which are based on multiples, IRR takes into account the time value of money. IRR can be used to measure both fund performance and the performance of an individual investment.

Related Resource → VC Fund Metrics 101

What makes IRR hard to predict in a fund context is cash flows happen at irregular periods because capital calls are made by funds on an as-needed basis. As an example, a fund calls capital only after the investment committee concludes their diligence in a startup company and is ready to actually invest. This is because funds don’t need all the capital from their limited partners at once and it actually helps a fund improve their IRR to call capital only when needed. When funds have too much cash on their balance sheet it hurts returns and is known as a “cash drag”.

How is IRR used by LPs

IRR is used by LPs in Venture Capital to benchmark a fund’s performance against relevant peer goups. LPs will take into account the time since the initial cash outflow of a fund and compare it against the timeline of similar funds in the same asset class.

Cambridge Associates publishes quarterly benchmarks and statistics compiling data from 2,300 fund managers and their over 9,400 funds. You can check out their reports here on the Cambridge Associates website.

Defining VC Fund Cash Flows

Since IRR is largely based on timing of cash flows it’s important to understand how cash flows are defined for a VC fund. Below you can find the definition of cash flows from the perspective of the LPs. An outflow is when LP gives money to the VC fund and an inflow is when capital is returned to LPs. Returning funds sooner and calling capital later can have a huge impact on the fund’s IRR.

Cash Outflow Examples

Capital Calls – the money funds request from LPs on an as needed basis to invest in companies

Fees – the most common is the fund management fee which is paid annually and covers GP compensation and can cover things like salaries, insurance, and travel. (Read more about different types of VC fees)

Expenses – Fund expenses can include items such as ongoing administrative and legal expenses and the VC’s tech stack.

Cash Inflows Examples

Distributions – the value of the cash and stock that the fund has given back (distributed) to the LPs usually after a liquidity event (when a portfolio company exits the VC portfolio through an acquisition, merger, or IPO).

Distributions are typically low early in a fund’s life, ramping up over time as investments are exited.

It’s important to note that IRR models can include interim returns which are just assumptions (best guesses) of when a return will be made to an LP. However, these assumptions are often incorrect and therefore can put the reliability of IRR projections into question. (Read more about interim vs final returns at the bottom of this article)

Gross vs Net IRR and Unrealized vs Realized IRR

There are several ways to evaluate IRR to get a comprehensive understanding of a fund’s performance. When reporting IRR to your LPs, it’s important to clarify how you’re defining IRR.

Gross IRR vs Net IRR

The difference between Gross and Net IRR is that the latter value is the annualized return after the deduction of management fees, fund expenses, and/or carried interest. Typically fees for a VC fund include a management fee which is usually 2% of the assets in the fund in addition to 20% of any of the profits.

Unrealized vs Realized IRR

Unrealized IRR is often opportunistic and for that reason can be incorrect. Unrealized IRR includes actual profits as well as theoretical profits based on private market valuation estimates. On the flip side, realized IRR includes only the actual cash flows that have been passed through to investors, also known as final returns.

Want to learn more about tracking key fund metrics in Visible?

How is IRR Calculated for Venture Capital Funds

Wrapping your head around the IRR formula can quickly put your brain in a pretzel so it’s recommended to use Excel, Google Sheets, or a platform like Visible.vc to calculate IRR.

In the IRR equation below, we’re solving for the discount rate (or the expected compound annual rate of return) that makes the net present value of an investment zero.

IRR is calculated by solving for the rate of return (“r”) of a series of cashflows (“C”) over a period of time (“n” to the total number of periods “N”):

Check out this article for an example calculation of IRR within the fund context.

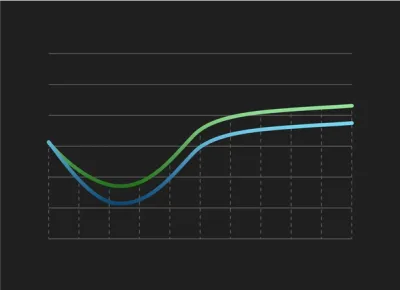

The IRR J-CURVE

The IRR of funds typically follow what is called a J-Curve because of the shape IRR takes when it’s mapped on a timeline. For most funds, IRR declines in the first couple of years because that’s when initial cash outflows (investments and expenses) are made. Then, as time progresses and initial investments liquidate through exits or IPO’s, the cash inflows increase. Returning funds sooner and calling capital later can have a huge impact on the fund’s IRR. (Read more in the J-Curve and IRR).

Putting IRR in Vintage Context

It’s important to also consider a fund’s IRR in the context of its vintage, also known as the first year the fund started deploying capital. The reason is that a negative IRR is expected within the first 4-5 years of fund’s existence so it’s not that meaningful of a metric. It’s important to remember that IRR becomes more meaningful as a fund matures. Only when a fund matures and real return values are available is the unrealized IRR (comprised of best guesses) put to the test.

Concluding Thoughts

IRR is an important metric used by VCs and LPs to evaluate fund performance and benchmark it against other funds in the same peer group. Unlike other fund performance metrics based on multiples, IRR takes into account the time value of money which makes it both a useful indicator of performance and also challenging to calculate on your own. IRR is most meaningful once a fund has existed for 4-5 years.

Tracking IRR in Visible

Visible lets you track and visualize over 35+ key fund metrics including IRR in one place. Get started with calculating your IRR by leveraging Visible's investment data features. Track the round details for your direct investments and follow on rounds.

investors

Metrics and data

Reporting

VC Fund Performance Metrics 101 (and why they matter to LPs)

Venture Capital investors expect their portfolio company founders to be on top of their key financial metrics at all times. Why? Because it fosters confidence in investors when CEOs demonstrate they’re making data-informed decisions about the way their company is operating.

On the flip side, Venture Capital investors should be just as familiar with their own key performance indicators, aka fund metrics. A great way to impress Limited Partners is to demonstrate you have a deep understanding of both how fund metrics are calculated and why they matter to LPs.

In this article we define the key fund metrics every fund manager should always have at the ready and why they are important.

Multiple on Invested Capital (MOIC)

Definition: MOIC is considered the most common fund metric and is used to determine the value of a fund relative to the cost of its investments. In other words, it measures the amount gained on investments. Anything above a 1.0x is considered profitable. MOIC can be an effective way for LPs to compare the performance of the Venture Capital funds they’ve invested in; however, because it includes both unrealized and realized value, it’s not a true indicator of fund performance.

How It’s calculated:

(Unrealized Value + Realized Value) / Total Invested into the Fund

Why it matters to LPs: MOIC is a straightforward metric that measures how much value the fund as a whole is generating over time.

Related resource: Multiple on Invested Capital (MOIC): What It Is and How to Calculate It

Gross Total Value to Paid-in-Capital (TVPI)

Definition: TVPI demonstrates the overall performance of the fund relative to the total amount of capital paid into the fund to date. A TVPI of 1.5x means for every $1 an LP invested, they’re projected to get $1.5 in value back as a return.

How It’s calculated:

(Total Distributions + Residual Value) / Paid-in-capital = TVPI

OR

DPI + RVPI = TVPI

Why it matters to LPs: This is an important metric for LPs because it demonstrates how much money they’ve (individually) received back to date from the fund as well as how much they are predicted to receive (residual value) after all the all assets (companies) have been sold as it relates to their (individual) investment. LPs like to use TVPI because it’s straightforward to calculate and hard to manipulate.

LPs will be ok with TVPI’s lower than 1 for the first few years but then will start expecting to see an TVPI of 1 or higher as your company’s hopefully get marked up in value and you start distributing fund back to LPs.

Related Resource: TVPI for VC — definition and why it matters

Residual Value per Paid-in-Capital (RVPI)

Definition: RVPI is the ratio of the current value of all remaining investments (after the GPs have done their mark up and mark downs) within a fund compared to the total contributions of LP’s to date. It essentially tells LPs the value of companies that hasn’t been returned (yet!) compared to how much has been invested.

How It’s calculated:

Residual Value / Paid in Capital = RVPI

Why it matters to LPs:

LPs want to know the likely upside of investments that haven’t been realized yet. For this reason, LPs are likely comparing your RVPI against funds with the same vintage.

Distributions per Paid-in-Capital (DPI)

Definition: DPI is the ratio of money distributed (returned) to LP’s by the fund, relative to the amount of capital LP’s have given to the fund.

How It’s Calculated:

Distributions / Paid-in-capital = DPI

Why it matters to LPs: LPs will be comparing your RVPI and DPI numbers to understand where your portfolio is at in terms of maturity. A high DPI means you’re portfolio is more mature because you’ve already been able to start making distributions back to your LPs as opposed to just have a high residual (potential payout) value.

Internal Rate of Return (IRR)

Definition: IRR is the second runner-up for the most common fund metric. IRR shows the annualized percent return that’s realized (or has the potential to be realized) over the life of an investment or fund. A high IRR means the investment is performing well (or is expected to perform well). If you’re a seed stage investor you should be targeting at least a 30% IRR according to Industry Ventures.

How It’s Calculated:

Because of the advanced nature of this formula it’s best to use an excel based calculator to calculate IRR or a platform like Visible.vc which automatically calculates IRR for you.

Related Resource –> What is Internal Rate of Return (IRR) for VCs

Why it matters to LPs: IRR gives LPs a way to measure the performance (or predicted performance) of their investments before other profitability metrics are available. This metric, unlike the others listed above, takes into account the time value of money, which gives LPs another perspective to evaluate your fund performance and compare it to other asset classes.

Check out the week from Revere VC below to get a better understanding of when each fund metric is relevant.

Venture fund metrics can get confusing.

MOIC, TVPI, DPI, IRR … ????

Beyond formulas, we teach our analysts about when to use them ⬇️

Fund still deploying? MOIC.

Investment window closed? TVPI.

Fund starts harvesting? DPI.

Historical performance when fund is complete? IRR.

— Revere VC (@Revere_VC) February 17, 2023

Tracking and Visualizing Fund Metrics in Visible

It’s important to make sure you understand not only how to calculate your key fund metrics but also why they matter to LPs; this way you can add an insightful narrative about your fund performance in your LP Updates.

Visible equips investors with automatically calculated fund metrics and gives GPs the tools they need to visualize their fund data in flexible dashboards. Dashboards can be shared via email, link, and through your LP Updates.

Visible supports the tracking and visualizing of all the key fund metrics including:

MOIC

TVPI

RVPI

DPI

IRR

and more.

Visible lets investors track and visualize over 30+ investment metrics in custom dashboards.

Over 400+ Venture Capital investors are using Visible to streamline their portfolio monitoring and reporting. Learn more.

founders

Fundraising

Reporting

The Top VCs Investing in BioTech (plus the metrics they want to see)

The biotech industry has always been an attractive sector for VCs to invest in, and 2023 is no different. With high potential for returns, a rapidly growing industry, and advances in technology, biotech is a favorable investment for VCs.

One of the main reasons for this is the high potential for returns. Biotech companies that successfully develop and commercialize new therapies and medical devices can generate significant returns for investors. This is particularly true for companies that develop therapies for diseases with high unmet needs, such as cancer, rare genetic disorders, and chronic diseases.

The biotech industry is also expected to grow significantly in the coming years, driven by advancements in genomics, stem cell research, and regenerative medicine. This presents a significant opportunity for investors to participate in the growth of this industry and benefit from its expansion.

Advances in technology such as gene editing, AI, and digital health are also making it easier for biotech companies to develop new therapies and medical devices, which can improve their chances of success. Additionally, the growing interest in personalized medicine is also a favorable trend, as precision medicine is gaining more traction in the industry. This approach, which is based on the genetic makeup of each patient, has the potential to lead to more effective and efficient treatments for a wide range of diseases, including cancer and rare genetic disorders.

Governments around the world are also investing in biotech research and development and are offering various incentives for biotech companies, which can help to reduce the financial risks for investors. The high demand for healthcare, driven by the increasing aging population and the growing burden of chronic diseases, is also driving the demand for new and more effective therapies and medical devices.

Set up Your Biotech Company for Success

Biotech startups have a lot to consider as they work to develop and commercialize new therapies and medical devices. There are several key steps that biotech startups can take to increase their chances of success.

Identify unmet medical needs

Successful biotech startups begin by identifying unmet medical needs in the market, and then developing products or therapies that directly address these needs. By doing so, they are able to differentiate themselves from competitors and demonstrate a clear value proposition to potential customers and investors.

Build a strong team

A strong management team with a diverse set of skills and experiences is crucial for biotech startups. This team should be able to lead the company through the complex and dynamic biotech landscape, and make strategic decisions that will help the company grow.

Leverage technology

Advances in technology such as gene editing, AI, and digital health are making it easier for biotech companies to develop new therapies and medical devices. Leveraging these cutting-edge technologies can give startups a competitive edge and improve their chances of success.

Create a clear path to commercialization

Developing a clear path to commercialization and having a strong business model in place are essential for biotech startups. This helps them to attract investment and partners, and to scale their business.

Build partnerships

Building strong partnerships with key stakeholders in the industry, such as pharmaceutical companies, academic institutions, and government organizations can provide access to resources, expertise, and networks that can help the startup to excel.

Have strong regulatory compliance

Successful biotech startups are aware of the regulations and compliance requirements in the biotech industry and they have the necessary processes and procedures in place to ensure compliance. This helps to avoid delays and ensure a smooth commercialization process.

Adapt to market changes

Successful biotech startups are agile and adaptable, and able to pivot their strategies and business models in response to market changes. This helps them to stay ahead of the curve and capitalize on new opportunities as they arise.

Biotech Metrics to Include in Investor Updates

Some specific metrics that biotech companies may include in their investor update include:

Clinical trial progress: The number of patients enrolled in trials, the phase of the trial, and any regulatory milestones that have been achieved or are upcoming.

Pipeline development: This includes compounds or products in development, as well as their potential for revenue or commercialization.

Intellectual property: Patents filed or granted, as well as the strength and potential value of the company’s intellectual property portfolio.

R&D expenses: The progress of research projects to investors.

Scientific publications and presentations: Scientific publications or presentations in which the company or its scientists have participated, as well as the level of visibility and impact of these publications and presentations.

Manufacturing and production: Updates on the progress of their manufacturing and production processes, including capacity and scalability.

Product development: Status on the development of a product, including the progress of preclinical studies, clinical studies, and commercialization.

Market size and potential for growth: The size of the target market for a product and its potential for growth, as well as the competition in the market.

Regulatory: Progress of regulatory approvals and submissions, including FDA, EMA, and other regulatory authorities.

Financial metrics: Such as revenue, operating costs, and burn rate.

The management team and Board of Directors: Any changes or updates to the management team and Board of Directors.

Partnerships and collaborations: New partnerships or collaborations that have been established or are in progress.

Depending on the stage of the company, some of these metrics may not be applicable or relevant and will vary from company to company or industry.

The Future of Biotechnology

The biotech industry is expected to continue to grow and evolve in the coming years, driven by advancements in technology and research. Biotech startups that are able to stay ahead of the curve and capitalize on trends will be well-positioned for success in the future. A few of these key trends are Gene therapy, Regenerative medicine, Personalized medicine, Digital health, and Artificial Intelligence.

Gene therapy is a promising new approach to treating genetic disorders and diseases by directly targeting the underlying genetic causes. Advances in gene editing technology, such as CRISPR, have made it possible to precisely target and repair disease-causing mutations, leading to the development of new gene therapies for a wide range of conditions.

Regenerative medicine is the practice of using cells, tissues, and organs to repair or replace damaged or diseased parts of the body. This field is rapidly advancing, with new therapies being developed for conditions such as heart disease, diabetes, and spinal cord injuries.

The use of precision medicine is gaining more traction, this approach which is based on the genetic makeup of each patient, has the potential to lead to more effective and efficient treatments for a wide range of diseases, including cancer and rare genetic disorders.

The integration of digital technology into healthcare is increasingly becoming a reality, enabling real-time monitoring and data collection, which will help to improve treatment outcomes. Biotech companies are now investing in digital health solutions, including wearable devices, mobile apps, and telemedicine, to improve patient care.

AI is becoming increasingly important in the biotech industry, with companies using machine learning and deep learning to analyze large amounts of data, including genetic data, to identify new drug targets and develop new therapies.

VCs Main Focus Areas in Biotech

Depending on the VC firm’s investment strategy and the portfolio the focus may vary but some general areas of interest include:

Biotechnology: Startups working on developing new drugs, therapies, and diagnostics, as well as those working on advancing biotechnology platforms such as gene therapy, CRISPR, and synthetic biology.

Medical Devices: Such as implantable devices, diagnostic tools, and digital health technologies.

Digital Health: Telemedicine, virtual care, and remote monitoring technologies.

Biotech IT: This includes startups working on developing new software and IT solutions to support the biotech industry, such as bioinformatics, computational biology, and data analytics.

Biotech Services: Such as contract research and development, clinical trial management, and regulatory consulting.

Biotech Agriculture: Startups working on developing new tools and technologies to improve crop yields, reduce waste, and improve food safety.

Biotech Energy: New biofuels, renewable energy, and sustainable materials

VCs Investing in Biotech Companies

8VC

Location: San Francisco, California, United States

About: 8VC aims to transform the technology infrastructure behind many industries.

Investment Stages: Seed, Series A, Series B, Growth

Recent Investments:

Oula

Anduril

Loop

Check out 8VC’s profile on our Connect Investor Database

Arch Venture Partners

Location: Chicago, Illinois, United States

About: ARCH Venture Partners invests primarily in companies co-founded with leading scientists and entrepreneurs, concentrating on bringing to market innovations in information technology, life sciences, and physical sciences. ARCH currently manages five funds totaling over $700 million and has invested in the earliest venture capital rounds for more than 90 companies. ARCH investors include major corporations, financial institutions, and private investors.

Investment Stages: Seed, Series A, Series B, Series C, Growth

Recent Investments:

Synchron

FogPharma

Treeline Biosciences

Check out Arch Venture Partners’ profile on our Connect Investor Database

5AM Ventures

Location: Menlo Park, California, United States

About: 5AM Ventures is a California-based venture capital firm that aims to finance seed- and early-stage life sciences companies.

Investment Stages: Series A, Series B, Growth

Recent Investments:

Escient Pharmaceuticals

CAMP4 Therapeutics

Dianthus Therapeutics

Check out 5AM Ventures’ profile on our Connect Investor Database

Atlas Venture

Location: Cambridge, Massachusetts, United States

About: Atlas Venture is the leading international early-stage venture capital firm, investing in communications, information technology and life sciences companies. Atlas Venture investments are evenly divided between the United States and Europe. Founded in 1980, Atlas Venture has organized six international funds, and currently manages more than $2.1 billion in committed capital.

Investment Stages: Seed, Series A, Series B, Growth

Recent Investments:

Nimbus Therapeutics

Be Biopharma

Triana Biomedicines

Check out Atlas Ventures’ profile on our Connect Investor Database

Forum Ventures

Location: New York City, San Francisco, and Toronto, United States

Thesis: B2B SaaS; Future of Work, E-commerce enablement, Supply Chain & Logistics, Marketplace, Fintech, Healthcare

Investment Stages: Pre-Seed, Seed

Recent Investments:

Sandbox Banking

Tusk Logistics

Vergo

Check out Forum Ventures profile on our Connect Investor Database

OrbiMed

Location: New York City, United States

About: We have been investing globally for over 20 years across the healthcare industry: from early-stage private companies to large multinational corporations. Our team of over 100 distinguished scientific, medical, investment, and other professionals manages over $17 billion across public and private company investments worldwide.

Investment Stages: Series A, Series B, Series C

Recent Investments:

Pathalys Pharma

Amolyt Pharma

MBX Biosciences

Check out OrbiMed’s profile on our Connect Investor Database

Polaris Partners

Location: Massachusetts, United States

About: Polaris Partners has a 20+ year history of partnering with entrepreneurs and innovators improving the way we live and work.

Investment Stages: Series A, Series B, Series C

Recent Investments:

Jnana Therapeutics

FOLX Health

CAMP4 Therapeutics

Check out Polaris Partners’ profile on our Connect Investor Database

Third Rock Ventures

Location: Boston, Massachusetts, United States

About: Telescope Partners is an active growth equity firm partnering with best in class entrepreneurs across the technology landscape. We invest ourselves and our capital in companies building long-term, sustainable businesses.

Investment Stages: Series A, Series B

Recent Investments:

Corvia Medical

Terremoto Biosciences

MOMA Therapeutics

Check out Third Rock Ventures’ profile on our Connect Investor Database

Versant Ventures

Location: San Francisco, California, United States

About: Versant Ventures caters to the healthcare sector with early and later stage venture, private equity, and debt financing investments.

Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

Recent Investments:

iECure

Jnana Therapeutics

Nested Therapeutics

Check out Versant Ventures profile on our Connect Investor Database

Sofinnova Partners

Location: London, United Kingdom

About: Sofinnova Partners is a venture capital firm that invests in the life sciences sector, from seed to later-stage.

Thesis: We invest in people and science to create opportunity. We commit to long-term partnerships with entrepreneurs who are as passionate as we are about pushing the frontiers of innovation to contribute to a better future.

Investment Stages: Seed, Series A, Series B, Series C, Growth

Recent Investments:

Amolyt Pharma

Micropep

Prometheus Materials

Check out Sofinnova Partners’ profile on our Connect Investor Database

F-Prime Capital

Location: Cambridge, Massachusetts, United States

About: F-Prime grew from one of America’s great entrepreneurial success stories. Fidelity Investments was founded in 1946 and grew from a single mutual fund into one of the largest asset management firms in the world, with over $2 trillion under management. For the last fifty years, our independent venture capital group has had the privilege of backing other great entrepreneurs as they built ground-breaking companies, including Atari, Ironwood Pharmaceuticals and MCI.

Investment Stages: Seed, Series A, Series B

Recent Investments:

Neumora Therapeutics

Elicidata

Ashby

Check out F-Prime Capital’s profile on our Connect Investor Database

Start Your Next Round with Visible

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VCs and accelerators who are looking to invest in companies like you. Check out all our investors here and filter as needed.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors and How to Cold Email Investors: A Video by Michael Seibel of YC.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

founders

Fundraising

Reporting

8 Ways to Level Up Your Investor Relations in 2023

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

2022 has been a challenging year in the startup world. After a hot start to the year, funding and growth has slowed. As Tomasz Tunguz pointed out in the chart below, funding has collapsed since October.

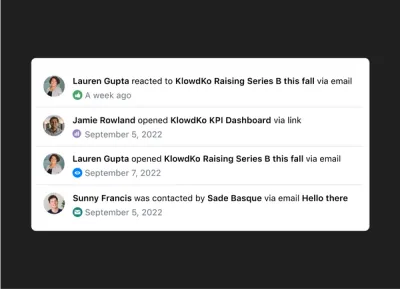

At Visible, we’ve spent 2022 building tools to help founders update investors, raise capital, and track key metrics. With the help of these 6 new features, founders will be able to level up their investor relations and strike when the funding iron is hot. Check them out below:

Share and Comment on Fundraising Pipelines

You can now share a fundraising pipeline via link. This allows you to ask current investors or peers for introductions or information about investors in your pipeline. In turn, your investors or peers can leave a quick comment to help make an introduction to investors they know.

Customize Fundraising Columns and Properties

Our fundraising pipelines have become more flexible so you can further tailor your pipeline to match your fundraise. With customizable fundraising columns and properties, you will be able to select the properties you would like to see at the pipeline level. Check out some of the most popular custom fundraising properties below:

Min & max check size

Who can make/made a connection?

Data room shared?

Investor type

Will they lead?

Log Emails with Potential Investors in Visible

With our BCC tool, founders will be able to simply copy & paste their unique BCC email address into any email. From here, the email will automatically be tracked with the corresponding contact in Visible. This is great for cold emailing investors, nurturing investors, and staying in touch with current investors. To learn how to get BCC set up with your Visible account, head here.

Automatic Fundraising Follow-up Reminders

Over the course of a fundraise, most founders should expect to communicate with 50-100+ investors. In order to best help you stay on top of their ongoing conversations, you can now set email reminders for when to follow up with potential investors. This is a great way to speed up the fundraising process and get back to what matters most — building your business.

Pitch Deck Branding and Custom Domains

Control your fundraise from start to finish. With Visible Decks, you can share your deck using your own domain. Plus you can customize the color palette of your deck viewer to match your brand. You can check out an example here.

Include Pitch Decks in Updates

Keeping current and potential investors in the loop is a great way to speed up the process when you are ready to raise capital. In order to best help nurture current and potential investors, you can now include your Visible Decks directly in Updates. This can help when kicking off a raise, nurturing potential investors, or sharing a board deck with your board members.

Custom Properties as Merge Tags in Updates

As we mentioned above, updating current investors and nurturing potential investors is a great way to speed up a fundraise when the time is right. To best help you customize your Visible Updates, you can now use custom properties as merge tags in Updates. For example, if you’re tracking the city in which your investors live you can use that in an Update.

Improved Dashboard Layout and Widgets

If you’re sharing Visible Dashboards with your team or more involved investors, you can now customize the layout and include additional widgets (like text, tables, and variance reports). This will allow you to give additional context to any of the data your key stakeholders might be looking at regularly.

Our mission at Visible is to help more founders succeed. Over the next 12 months, we’ll be building more tools to help you do just that. Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

founders

Reporting

Wringing Out Investor Updates

A few years ago we interviewed Lindsay Tjepkema, Founder of Casted, about starting a podcast. One of her key tips was to “wring out your content.” If you’re going to take the time to record a podcast, you should take the time to repurpose and distribute that content on different channels.

How to Repurpose Investor Updates

The same is true for investor relations and fundraising. If you’re going to take the time to send an investor update, you can “wring out” your metrics, big wins, asks, audience, etc. to fuel other fundraising materials. An investor update can be re-purposed to help build out other fundraising assets — for example:

Potential Investor Monthly Updates — For a simple hack, take your normal investor update and edit it down to a few key metrics and wins to nurture potential investors.

Pitch Decks — If you’re sharing data in your investor updates, this can be used to help build out the different metrics and data you’ll need in a pitch deck.

Data Rooms — Data rooms are a combination of all of the data and assets you’ll share over the course of a fundraise. Including past investor updates is a surefire way to show potential investors your history of regular communication.

Cold Emails to Investors — Investor updates can be a starting point for crafting a cold email to potential investors.

Board Decks — There is likely a lot of crossover between the content in an investor update and a quarterly board meeting. Investor updates can be a great backbone for building out the different slides in a board deck.

Team Updates — A modified version of your investor update is also a great way to keep your team in the loop and build trust.

Investor communication is no easy feat for founders. Taking the time to send monthly updates already puts you ahead of 50% of portfolio companies — taking the few minutes to wring out your investor updates will help you speed up your next raise when you are ready.

Reading List

How to Handle: Keeping Your Investors Updated

Brett Brohl of Bread & Butter Ventures breaks down the 5 components he likes to see in investor updates. Learn more

Investor Outreach Strategy: 9 Step Guide

On the Visible Blog, we share a 9 step guide to help founders develop a plan to reach out to potential investors. Read more

Why You Should Always Send Your Investor Updates

Kera DeMars of Hustle Fund makes the case why founders should send investor updates. Read more

investors

Reporting

Fundraising

Tips for Writing LP Updates for Emerging Managers (with Templates)

The General Partner (GP) and Limited Partner (LP) relationship is built on trust. The best way to establish trust with LPs is through transparency, authenticity, and regular communication. When LP reporting is done well, LPs should easily be able to understand how both the fund and the fund manager are performing and be able to use this information to inform their investment strategies in the future.

The best GPs view sending LP Updates as a relationship-building activity and as a fundraising tool — not as a way to simply check off a requirement from their LPA’s.

For emerging managers, your relationships with initial LPs are of critical importance for your reputation as a fund manager and future fundraising. This rapport forms the basis of the fund manager’s credibility and will surface again when future LPs are doing diligence on the emerging manager. First-time fund managers will need to have clean data to support their track record and positive relationships with current LPs to set themselves up for success in raising additional funds.

The Weekend Fund recently wrote a thoughtful article on How to Write LP Updates with four main takeaways:

Send LP updates consistently

Go beyond the basics

Be authentic

Don’t share sensitive information without portfolio founders’ sign-off

We’ve translated this guidance into actionable steps that can be streamlined with Visible’s Portfolio Monitoring and Reporting tools below.

1. Send LP updates consistently.

Weekend Fund Advice — “One of the biggest mistakes new fund managers can make is not sending LP updates consistently. Most send quarterly updates. At Weekend Fund we send updates approximately every two months. Regular, detailed, and transparent updates builds trust with your LPs, which is particularly important if you want them to write a check into your next fund.”

Visible provides fund managers with tools to make sending updates to LPs on a regular basis easier.

To start, you can Upload Your LP Contacts (including custom contact fields) via CSV within seconds. Then you can create Custom Lists to organize your contacts. We suggest organizing your LPs by Fund and also by whether they’re a current LP or a potential LP.

This means within minutes you have all your contacts organized into custom segments that are useful to you. You can then simply choose which list you want to send an Update to in the future.

Visible also streamlines the creation of your LP Update content by letting you choose from an Update Template Library. You can easily pull a template into your account, further customize it as needed, and save it as your own template to use for future updates.

2. Go beyond the basics.

Weekend Fund Advice — “Of course, you should introduce new investments, share updates from the portfolio, report performance metrics, and other key updates from the fund, but the best updates go a step further to educate and inform LPs. This might include your analysis on the market, perspective on emerging trends, or learnings from experiments.”

Visible’s LP Update editor supports rich text, videos, images, files, and perhaps best of all — custom data visualizations. This means you can visualize your custom fund analytics that will resonate with your LPs and embed them directly into your Update. The data is derived from data hosted within your Visible account and updates your charts in real time.

It’s also a great idea to include a market overview section at the top of your update to shed light on how you’re evaluating and staying ahead of the curve in the markets in which you invest. This is a great way to continue to instill LP confidence in you as the steward of their capital. On top of that, it’s important to remember that “many LPs invest in funds as a learning opportunity. The updates are the primary artifact to support that learning.” (Source)

You can also stand out to LPs by getting creative and embedding a video recording of your recent portfolio updates directly into your Updates. Open the update below to view an example of how a Visible customer incorporates video into their updates —

—> View Update Example with Video Embed

3. Be authentic.

Weekend Fund Advice — In general, people gravitate toward authenticity. Writing with personality is more engaging and magnetic. LP updates are an opportunity to share your unique voice and build your fund’s brand.

The Weekend Fund incorporates authenticity in their updates through their narrative updates and transparency, but also by including personal photos.

Visible lets you embed personal photos directly into your Update in two clicks.

—> View the Weekend Fund’s Update Template

4. Don’t share sensitive information without portfolio founders’ sign-off.

Weekend Fund Advice — “Fund managers often have inside knowledge into how a company is doing. Some founders are extremely sensitive to information shared about their company, even when the news is positive. It’s prudent to get approval for any non-public information shared with LPs.”

Visible recommends explicitly asking for portfolio company’s permission to share information with LPs. One way to do this is by incorporating it into the descriptions of your Request blocks. (How to Build a Request in Visible).

Here’s an example below —

It’s important to remember that as a GP you’re not only competing with other GPs for LP capital but also with every other asset class. So it’s to your advantage to use every tool in your toolkit to stand out and impress LPs.

Over 400+ VC funds are using Visible to streamline their portfolio monitoring and reporting processes.

founders

Reporting

The 5 Metrics VCs Want to See

The world has been consumed by data and metrics — startups are no exception. Founders need to leverage their key data and KPIs to fuel growth, build products, create interest from potential investors, and more.

At Visible, we have a tool built for VC funds to collect data from their portfolio companies and enable GPs to report to their investors (LPs). In order to better help founders determine what metrics they should be tracking, we analyzed our data and found the most common metrics VCs are collecting from their portfolio companies. Check them out below:

The Most Common Metrics

Revenue

Cash

Headcount

Customers / Users

Total Operating Expenses

The 5 metrics above are high level metrics that might sound obvious. However, great founders are able to recall them at anytime. Not knowing your key operating metrics is a ????. These can be used as the backbone for investor updates, board meetings, and determining more granular metrics to track.

P.S. 75% of investors are collecting anywhere between 1 and 10 metrics so chances are your own investor updates should land in the same range.

Reading List

Key Insights from High Alpha’s Finance Leaders

The team at High Alpha shares key takeaways from the finance leaders in their portfolio — they share why efficiency metrics are key in the current market, how data storytelling can be a differentiator, and more. Read more

Time to Refine Your Metrics: Defining Growth and Success at a PLG Company

Mikaela Gluck of OpenView Ventures highlights the key metrics that product-led companies should be tracking. Read more

6 Metrics Every Startup Founder Should Track

On the Visible Blog, we share 6 basic metrics that every founder be tracking and sharing with their stakeholders. Read more

founders

Reporting

Build Stronger Investor Relationships with Video Updates

The following is a guest post from the team at Sendspark. Use Sendspark to connect with customers, investors, team members, and other stakeholders. Learn more here.

Communicating with investors is a skill all founders should hone. Regular and predictable communication is a surefire way to build trust and improve your odds of unlocking an investor’s capital, network, experience, and more. Learn how you can leverage video + email updates to communicate with your investors below:

Why Send Videos in Investor Updates

Whether you’re pitching new investors or updating existing ones, sending videos to investors can help you build investor relationships.

Here are some ways it can help you:

Stand out from the crowd

Build a personal relationship

Show, rather than tell

Save time

Have great communication skills

Let’s dive into the best use cases and strategies that are going to help you close your next round!

When to Send Videos to Investors

1. Investor Outreach

A strong video in your investor pitch can help you get that first conversation.

One question that comes up a lot is should you make a personalized video when pitching investors?

And the answer is a bit nuanced. The world seems to be changing, but right now, I’d still recommend getting a warm introduction to an investor (even if that means cold emailing one of their portfolio founders), and using a video as a supplemental material in your “forwardable email”.

This helps you play it cool, while still getting valuable information across in your blurb and video.

Personalized videos become significantly more important after the first meeting, on your way to closing the deal.

2. Investor Follow Up

Sending a video recap after an investor conversation is a great way to lock in key points. Investors might have had 10 other conversations with strong founders that day, so this short video can remind them what they liked most about you. It can also help you stand out among the competition.

A video recap will give investors a shareable clip to pass around to other partners or decision makers at the firm who didn’t get to speak to you directly. This way, the wonderful aspects that make your pitch unique won’t get lost in translation.

For this video, I’d 100% recommend making it truly personalized to the investor you spoke with. Don’t try to include everything about your business, just the key points that you found best resonated with them during the call.

3. Diligence

When it comes to diligence, video messages can help you speed up the process. Here are some ways you can use video to get to a “yes” faster:

Record over your usage dashboards or product metrics

Request video testimonials from customers who can advocate for your product

Respond to any objections or concerns thoroughly

4. Investor Updates

An investor investing is the first step in a long partnership. Great investor communication over time will help you build a strong partnership, help investors help you, and lead to subsequent checks in future rounds.

Just like in B2B Sales, it’s easier to get your existing customers to pay more than to close new customers. Never take your investors for granted, and continue to keep them informed and excited about what you’re building.

Here are some ways you can strengthen your investor updates with video:

Record yourself discussing your current initiatives

Show off a new feature or product launch

Introduce a new team member or advisor

Request a video from a customer to share why this matters to them

How to Send Videos in Investor Updates

You can send videos in investor updates using Sendspark and Visible together. First, create a free account with Sendspark to easily record videos of yourself or your product.

Sendspark is great for this because…

It’s super fast to record a video of yourself or your product — no editing needed!

Videos will automatically look polished and professional with your own branding and logo