Fundraising Levers — Managing the Supply & Demand of Your Startup’s Fundraise

Elizabeth Yin is the Founder and General Partner at Hustle Fund (and one of our favorite follows on Twitter). A few weeks back she Tweeted that fundraising is all about managing the supply and demand. As she put it, “Supply of your round. Demand from investors.” (To pick Elizabeth’s brain on the matter, we hosted a webinar with her last week. Check out the recording here.)

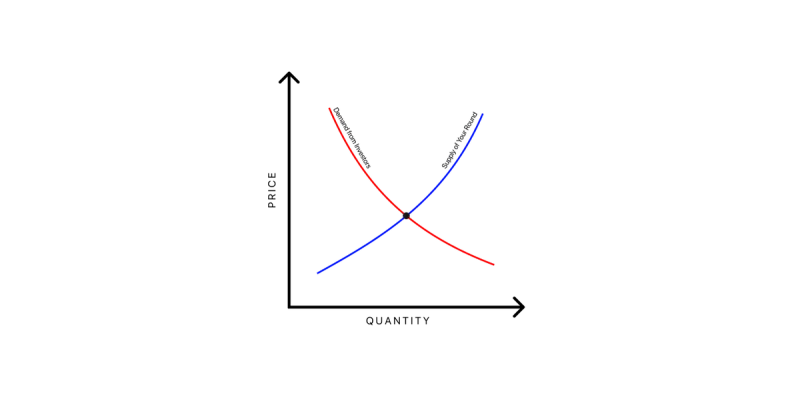

Before I dive into what this is, let’s take a step back. Fundraising is all about supply and demand.

Supply of your round. Demand from investors.

It’s hard to control demand from investors. But you can constrain the supply in your round to get it done.

— Elizabeth Yin (@dunkhippo33) May 29, 2020

Rewind to your Economics 101 course and you’ll remember the supply and demand curve all too well. To jog your memory, “The price and quantity of goods and services in the marketplace are largely determined by consumer demand and the amount that suppliers are willing to supply. Demand and supply can be plotted as curves, and the two curves meet at the equilibrium price and quantity.”

So what does this have to do with startup fundraising? Well, a lot actually.

Managing the Demand from Investors

Managing the demand for your round from investors can be difficult. If you don’t have the combination or product, market, or team that an investor is looking for, drumming up demand might be difficult. However, there are a few levers you can pull to generate demand and encourage investors to move faster.

If you look at your startup through the eyes of the investor, most of the time it is not beneficial for them to make an investment now. They will only benefit from waiting to see more data to make a more informed decision on your investment in 6 months. As Elizabeth explains, “It is your job as a founder to build impetus for investors to move now.” You want them to feel like the deal won’t be on the table in 6 months.

The best way to do this is to generate demand from a large group of investors. This means that you are running a strong process and talking to as many investors as possible to drum up demand. This will create a fear of missing out for investors as you continue to push forward with meetings and new investors. As Elizabeth Yin puts it, “you want investors to be afraid of each other.”

Constraining the Supply of Your Round

When it comes to raising a smaller round drumming up demand almost feels impossible. At earlier stages, you likely lack a product or strong traction metrics that forces investors to move fast. Additionally, you’ll likely be talking to smaller investors and cashing smaller checks that don’t create the urgency for larger firms to jump in before the round is closed.

Tranche Strategy

One way Elizabeth Yin suggests to constrain the supply of your round is by using a tranche strategy. “As an example, Elizabeth uses a seed company going out to raise $2M total. This company may go out and raise a smaller tranche to create some demand from investors to move quickly. For example, if the smaller tranche is $500k investors may have a fear they will miss out as it is a smaller size round that is easier to raise. From here, it is a lot easier to go to larger investors as you can create some urgency around the round as you’ve already raised $500k.”

Ask around and see what your founder and investor think about trying a tranche strategy. While some investors may not agree with a tranche strategy it is up to you as a founder to make the decision that is best for your business. Tranches can certainly be a powerful way to manage the supply and demand of your round.

Take on Your Investors in Sets

Another strategy to constrain supply and build demand is by taking on your investor meetings in sets. As the team at First Round Review puts it, “There’s nothing worse than the perception of an over-shopped deal, as VCs relish having the inside scoop on an exciting company. Group investors in batches to better evaluate and select them, like a surfer scanning sets of waves that move toward the shore.”

Regardless of how you look at it, fundraising essentially turns into a founders full time job. By accepting this, you’ll be able to stack your meetings for a full schedule. This will allow you to talk to new investors regularly and build a strong process. As you continue to escalate conversations with different investors, this will also create a sense or urgency that the deal is moving forward and now is the time to get in on the terms.

Fundraising is hard in good times and challenging times. By building a process and understanding what levers you can pull you will only increase your odds of a good raise.

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.