How to Pitch a Perfect Series B Round (With Deck Template)

With an average round size of $58M, a company’s Series B Round is a serious endeavor. Early funding rounds such as pre-seed, seed, or even Series A, are all about showcasing the potential for your business and generating monetary buy-in to make that potential a reality. With a Series B, the stakes are much higher.

A Series B Round is about building on proven momentum and securing further confidence that your business continues to be a strong, fast-growing, and profitable investment for the VCs and private investors participating. Instead of proving to investors why they should help launch or fuel the early potential of your business, a perfect series B round pitch deck is all about demonstrating to investors that your company is a rocketship and this is their ticket to the moon.

Examples of Series B Funding Rounds

Making it to a point in your business where it makes sense to raise a Series B round. With less than 5% of SaaS startups making it past the first year, raising any money at all is a risk and an opportunity most companies don’t even get. With the high growth that is possible with significant Series B funding, it’s important to understand what a Series B round even looks like. We’ve outlined 5 different Series B rounds to explore:

Iterable – $23M

In December 2016, Iterable announced their 23M Series B round. Iterable is a cross-channel platform that powers unified customer experiences and empowers marketers to create, optimize and measure every interaction throughout the customer journey. The company has gone on to continue it’s massive growth raising over $300M to date. . Their 2016 Series B was led by Index Ventures, with participation from CRV and previous angel investors. Per a note from their CEO, the round’s purpose was presented for product-specific innovations alongside marketing, sales, and engineering team growth.

Lattice – $15M

After launching in 2015 and participating in Y-Combinator in 2016, the performance management platform scaled quickly, raising a $15M Series B in 2019. Although on the smaller side of Series B, the investment was led by Shasta Ventures with participation from Thrive and Khosla Ventures as well. At the time of their series B, Lattice had surpassed the 1,000 customer mark – providing incredible credibility and excitement for the investors participating in this round.

Beekeeper – $45M

Beekeeper, the mobile platform for frontline communication, raised a significant Series B to kick off 2021. The Swiss-based company with offices in Poland, Germany, and the US raised this round with a large number of investors participating. The round was co-led by Thayer Ventures and Swisscanto Invest, with participation from other investors including Atomico, Alpana Ventures, Edenred Capital Partners, Fyrfly, Hammer Team, High Sage Ventures, investiere, Keen Venture Partners, Samsung NEXT, Swiss Post, and Swisscom. Beekeeper’s largest target market is the hospitality industry and after the large hit that industry took in 2020, the demand for technology to improve employee retention and effectiveness is more in-demand than ever making the value of Beekeeper higher than ever and a strong catalyst for this funding round.

Evernote – $10M

Throwing it back to 2009 when the financial market was uneasy, Evernote was able to prove enough value in a risky market to raise a $10M Series B. The suite of software for organizing notes and information across multiple platforms has universal appeal with a product-led growth strategy in place. This round was led by Morgenthaler Ventures, with participation from prior investors including DOCOMO Capital and Troika Dialog. Despite their ability to raise funding even in a questionable financial period, Evernote is a cautionary tale of more money, more problems. Despite the resources, they struggled with product decisions, leadership, and execution and have since been surpassed and fallen behind in their space.

Calendly – $350M

To close out the examples, we have to highlight one of the largest Series B rounds in recent memory. Calendly, the modern scheduling platform, raised a staggering $350M at the start of 2021 from OpenView Ventures and Iconiq. Prior to this incredibly large round, Calendly had only raised $550,000 but had 10M monthly users and 70M in subscription revenue last year. Poised as an especially valuable piece of software for the new wave of remote work as the norm, Calendly had the right validation and timing to close out this impressive round.

Related Resource: Best Practices for Creating a Top-Notch Investment Presentation

How to Get Investors Excited About Your Series B Pitch

As a founder, its critical to bring a specific set of qualities and elements to the boardroom for your Series B pitch. The stakes are higher and confidence and preparedness are more critical than ever before. We suggest implementing a few tactics and pre-work steps to ensure the investors you’re pitching get excited by your series b pitch.

Analyze and Prepare

The quickest way you’ll lose credibility with an investing team is by coming unprepared to speak to the numbers. The SaaS metrics of your business should be your guiding light. Know them front to back, run through all the possible questions that each metric could spur. From average deal size to burn rate to ARR, make sure you have it down pat and expect the toughest questions about the data to come your way. If you thoroughly analyze and prepare to present the data completely with clear, data-driven rationale for every business decision and outcome fueling your Series B ask, you will prove major credibility to your potential investors and give them the confidence that their money is going to a team with the business savvy to handle and spend every dollar efficiently.

Lead with Confidence

You’ve got the SaaS metrics of your business down and could recite them in your sleep. However, if your delivery and presence during the pitch fall flat, it might not matter. Confidence is key when executing your Series B pitch. Show that not only do you know your numbers but that you know your business is in fact an extremely valuable business opportunity for these investors to participate in. Nobody wants to invest millions of dollars into a founding team that doesn’t seem to believe they can become a billion-dollar business. SaaS founders don’t become founders because it’s a quick way to make money. Rather, they validate a great idea and take big risks to realize that idea. This takes confidence to do well and that same confidence is critical to bring to the Series B pitch, a big step on the way to this big goal.

Tailor to Your Audience

Typically with a pre-seed, seed, or Series A round the firms you may be pitching are smaller and there might even be more of a focus on individual angel investors or friends and family. With Series B, the opportunity may be present to pitch to much larger, more established firms with prominent and successful investing experience. It’s crucial to keep this in mind and tailor your pitch to this new type of audience. Research your potential investors’ portfolios, understand their previous investments and position in your pitch, how an investment in your company is complementary to their current portfolio and investment style as well as how you add a new value and new opportunity not currently present in their portfolio today.

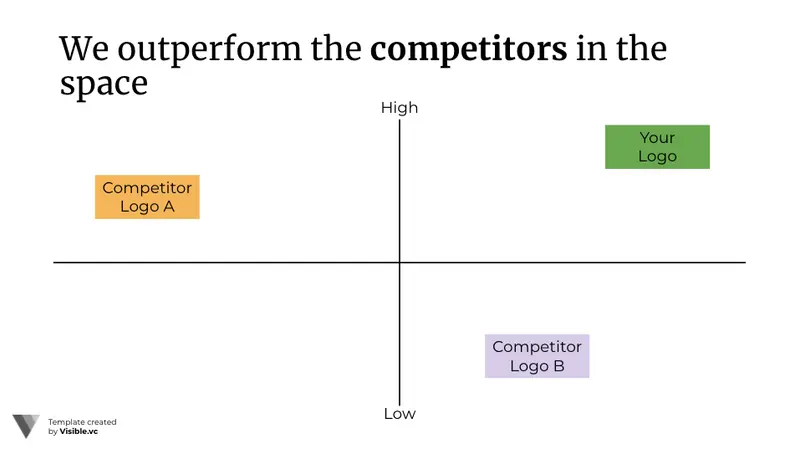

Understand Your Competition

While competitors can be tough for your sales team to navigate FUD and a pain in the side for your product team to ensure innovation and differentiation, strong competition can actually be a key sign of validation for your business to investors. However, it’s absolutely critical that you understand your competition inside and out for your Series B pitch. Competition shows that there is demand in the market (as there should be if you’re at the point of asking for Series B level money), but if you can’t properly differentiate why you win and why your take on the market is the superior one then an investor may choose to pass and seek out other investment opportunities in your space.

Dig into the metrics of your competition as much as you do your own business. Spend time in your pitch highlighting the competitive landscape and outlining clearly (with confidence) the key differentiators for your biz and how you plan to lead the market. This will show investors that you are keenly aware of challenges and how to analytically approach those threats – showing good business sense.

The Perfect Series B Pitch Deck (Step-by-Step Template)

As with Series A, you might not have a lot of time to communicate your investor pitch or you may be one of the dozens of pitches that a particular investment team is hearing that day. This makes your pitch deck critical to nail. As a starting point, get an idea of strong pitch decks from Seed and beyond to understand the general styles and methodologies that have historically worked well for other SaaS companies. Bonus points if you study successful decks from the portfolios of investors you’re pitching to.

Related Reading: 18 Pitch Deck Examples for Any Startup

We recommend the following flow to ensure you capture the right information and nail your Series B Pitch. Fewer slides is better but each slide can be extended into a second slide as needed:

Problem Slide

Make it crystal clear what large problem exists, with specific emphasis on how big said problem is. Emphasize the metrics of the problem, how expensive is it? What is the potential financial opportunity in this problem space? If you’re asking for a big sum of money to solve said problem, it’s critical to really prove outright from the start of your pitch how critical that problem really is.

Solution Slide

Introduce your company as the solution to that massive problem. Keep it simple with a clear statement of what your company is and how you solve the problem. The solution equals your company and your company’s mission statement is how you aim to solve this massive problem.

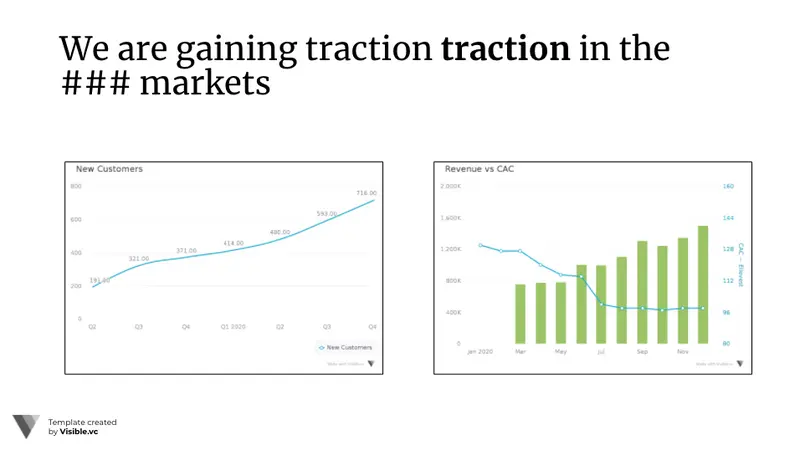

Metrics Slide

Why are you worth a fair chance to solve the problem you’ve outlined? With seed or Series A it’s proving that the idea is strong and you have early signs of validation. With Series B, let existing success metrics validate this for you. Showcase significant growth metrics such as customer count, month over month or year over year growth, ARR, etc… Use these numbers to clearly capture and hold attention.

Competitive Landscape and Advantage

Further, call out that the problem your company solves is one worth solving. Highlight the market including any significant competitors, both indirect and direct, and concisely share how your approach to this problem is different and stronger. Further, validate with growth data vs. competitor growth data if possible.

Related Reading: How to Model Total Addressable Market (Template Included)

Product Highlights

Naturally, your potential investors want to see the product but don’t think that means they have time for a full-fledged demo. Share 1-2 slides highlighting how the product works with some screenshots or a quick peek at the live platform. Make it clear how your end-user would interact with the product but don’t feature dump.

Product Roadmap

Talk about the possibility and future of your product. What will you do in the next 6 months, years, 5 years? Highlight how your product evolves with the problem and continue to expand its footprint in your defined space.

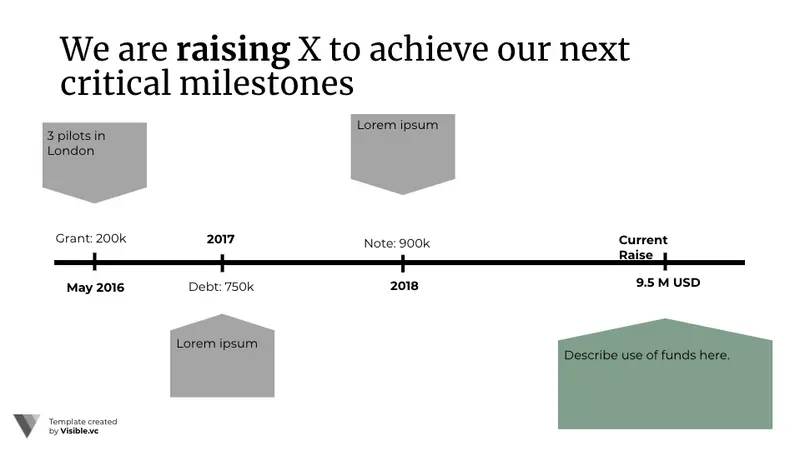

Funding Use Plan

Outline how you plan to use Series B funding. For most companies, this is a natural expansion of the product roadmap. However, if you have other growth plans such as hiring etc.. highlight that need to and what that expansion will let you do to scale and make money for your investors even faster.

Team Slide

Prior to closing, make sure to highlight the amazing team you work with. Highlight your executives, the existing board members, and investors. This is a good way to close with credibility and highlight the connections and team supporting what you do.

Closing Slide

Keep your close simple. Re-highlight your company mission and the big problem you plan to solve, thank the investors for your time, and open up for any questions if appropriate.

Prepare Your Investors In Advance

Just as you did with a seed round or Series A, the more you can prepare your investors (or potential investors) ahead of the time set for the actual Series B pitch meeting, the better.

Plan to circulate the deck, a summary of your current terms sheet, high-level company info for new investors, and key metrics no later than 48-hours prior to your pitch. This will ensure that all investors and potential investors have a clear understanding of what your ask is and who your company is today. This pre-understanding will make your time more valuable and even allow investors to come prepared with or share questions before – making the time more valuable and pointed for all. Alongside your series B pitch deck, a simple company introduction deck can prove to be extremely valuable.

How Visible Helps Startups Raise More in Series B

The Series B Pitch is a major milestone for startup founders to achieve. You’ve shown your business is on the right path, have credible early success in the market, and are ready to take on more serious amounts of capital to scale. Mastering the Series B Pitch is possible by following a clear, data-driven, and confident approach, tailoring to your audience, and deeply understanding your competition as the landscape for your space takes off. The Visible pitch deck for a Series B Pitch offers a straightforward template for success with this next-level investment task. Visible is helpful for companies at all stages of growth but especially helpful for founders looking to improve and expand their investor communications. Check out a free trial of Visible – create your account and get started today.