While a business plan might feel like a dying practice for startups there are countless benefits of building out and thinking through a plan. A startup business plan can be the backbone of pitch decks, investment memos, and strategy as you set out to build your startup.

Related Reading: How to Secure Financing With a Bulletproof Startup Fundraising Strategy

In our guide below, we lay out 8 concepts that will help you build a business plan as you begin your startup journey. You can skip around to specific sections below:

Eight Key Concepts To Include In Your Business Plan

As we mentioned above, the 8 concepts below are a great starting point to think through when forming your business. Inevitably, you’ll face questions and issues around all of the issues so having a well-thought-out plan and approach to each will pay dividends as you build your business.

Related Resource: How to Create a Startup Funding Proposal: 8 Samples and Templates to Guide You

1. Build an Executive Summary

As put by the team at Inc.com, “The summary should include the major details of your report, but it’s important not to bore the reader with minutiae. Save the analysis, charts, numbers, and glowing reviews for the report itself. This is the time to grab your reader’s attention and let the person know what it is you do and why he or she should read the rest of your business plan or proposal.”

An executive summary is an opportunity for you to layout the contents of your business plan and set the stage for what is to come. Avoid going too deep into detail and rather lay out the backbone of your plan. You want to balance getting the reader’s attention with supplying the information they need to get a grasp of your report.

A few items that we suggest you include:

- What is this product service/service?

- Who will benefit from this product/service?

- Who is competing with this product/service?

- How will you execute on selling your product/service?

As you continue to build out other sections of your business plan, the executive summary might change as you tweak other components.

Related Resource: A Complete Guide on Founders Agreements

2. Identify Your Business Objectives

First things first, you will want to layout the objectives of your business. This should be a deeper dive into what exactly your company does and how it is set up. This will be your opportunity to highlight your market and communicate why your product/service is set up for success. This is also a chance to hit on the mechanics of your business (structure, model, etc.).

A few items that we suggest including when laying out your business objectives:

- Gives investors a brief overview of what your company does

- Communicate the value of your product/service

- Highlights the market opportunity

You will have an opportunity to go into more depth in each of the details above later in the plan so make sure you are giving just enough detail to build interest and give investors a solid understanding of your objectives.

3. Highlight Your Companies Products and Services

Next, you can start digging into the fine details of your products and services. You will want to build excitement here and let investors know exactly what your product offers and why it is built to solve a big problem and win a market.

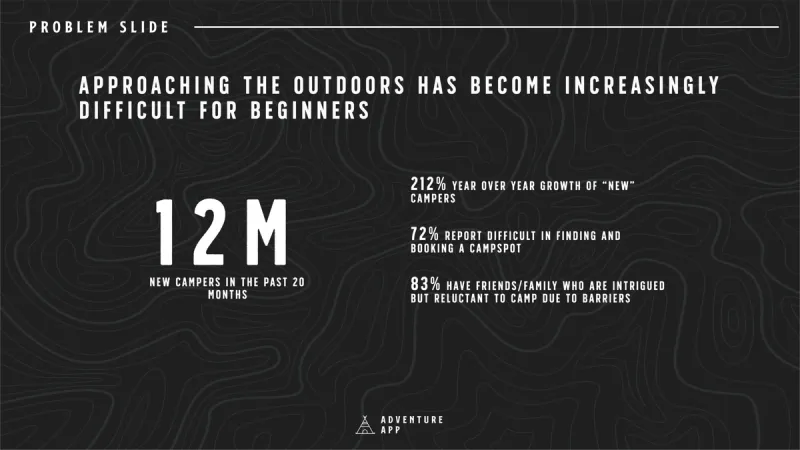

This is a great opportunity to present any qualitative or quantitative data you have about the market and your ideal buyer. Layout the problem and make your investors feel the pain that you are trying to solve. For example:

Let’s say you have an application that helps people find and book a camping site. You might want to lay out the problem you are solving below:

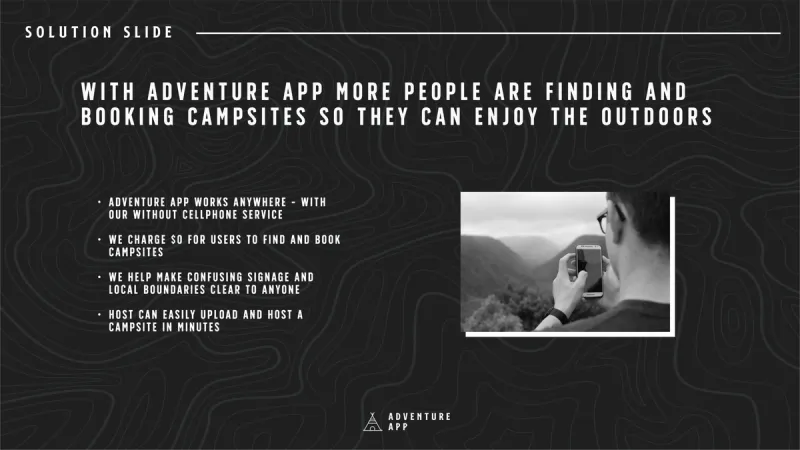

Next, layout how and why your solution is solving the problem like the example below:

A few other things you will want to make sure you include when highlighting your product or service:

- Face-to-face research on problems in the market

- How does this product solve the market’s problem?

- Data that suggests people are feeling the same pain point

- Stories from existing or potential customers that highlight the pain points

The goal here is for you to have your investors understand the problem and start building empathy.

Related Resource: How to Write a Problem Statement [Startup Edition]

4. Define Market Opportunities

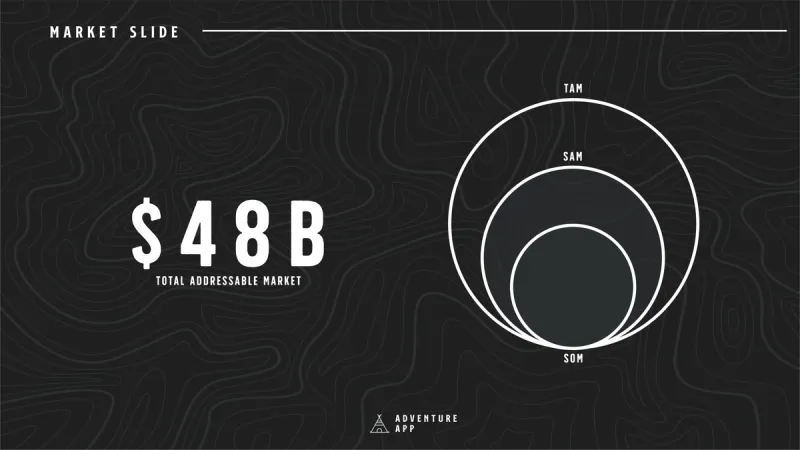

After you have laid out the problem and solution, you can start displaying the hard data behind the market. Venture capital follows a power law curve so chances are investors will want startups to demonstrate a large market and the potential to capture a large percentage of the market.

One aspect is modeling your total addressable market. You’ll want to demonstrate a large market that piques the interest of investors. Make sure to use real numbers and a bottoms-up approach here.

In addition to demonstrating your addressable market, we suggest including a few of the ideas below:

- Do research on the target audience

- Who is the target demographic for your product/service?

- What is the target location for your product/service?

- What is the typical behavior for your target audience?

Related Resource: When & How to Calculate Market Share (With Formulas)

5. Complete Your Sales and Marketing Plan

Now that you have demonstrated your product and the greater market it is time to start digging into the specifics of you will attract and close new customers. At the end of the day, bringing in revenue is the goal of a business to having a strong go-to-market strategy is an important aspect of your startup’s business plan.

If you’ve correctly laid out your market and the demographics of your target market in the previous sections, investors should have a strong understanding of the space and will be able to have a conversation around your sales and marketing strategies.

You don’t need to go into overwhelming detail here but laying out what channels you will rely on and how you will execute and hire on those channels is necessary. For example, if organic search is a strategy you can lay out what you are doing to execute on that channel but do not need to mention the specific posts and content you are creating here.

To make sure you nail this section, be sure to include a few of the following:

- Sales channels

- Marketing objectives

- Early data points and success

If you do not have any hard data points yet, no worries. Use your research and market data to build compelling cases for different acquisition strategies.

Related Resource: 7 Startup Growth Strategies

6. Include a Competitive Analysis Report

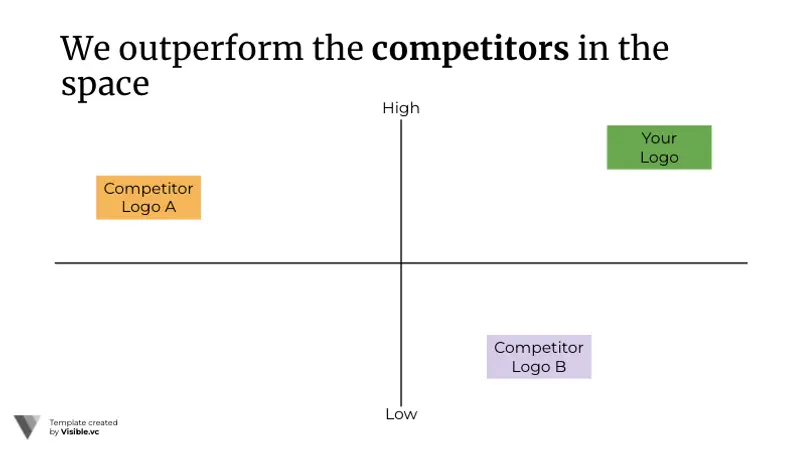

Of course, investors will want to know about the competitors operating in your market. They will want to understand how you are differentiated and why you are poised to beat them in the space.

You’ll want to make sure you are clearly demonstrating who is operating in what aspects of the space. Compare your product or offering to them. Remember to be honest here as investors always have the ability to double-check your research and will do their own analysis of your competitors.

A common way to show this information is by using a market map. Check out an example of what a market map looks like below:

Related Resource: Tips for Creating an Investor Pitch Deck

7. Structure Your Operations and Management Teams

In the early days of a business, most investors will be taking a chance on the founding team and management team. They will want to look at your team’s past experiences and skillset to understand why they are the ones that should execute on a problem.

Highlight what managers and leaders are responsible for what aspects of the business and use their past experiences and skillsets to show why they are fit for the role.

You can also use this as an opportunity to demonstrate hiring plans and how your teams will be structured as you continue to grow. Here are a few examples of what you might want to include:

- Define your team of experts and what tasks they are responsible for.

- Consider adding an organizational chart to clearly outline your companies structure

8. Financial Analysis

Finally, you should include financial analysis for your business. Depending on who you are sharing your business plan with might depend on the level of financial analysis you would want to share.

If you already have financials and data be sure to include the last 12 months of data. Make sure the data is incredibly easy to understand decipher. You don’t want someone to be looking at your financials and take things out of context to draw conclusions about your business that might be wrong.

Another aspect you’ll want to include is your financial forecasts and goals. While chances are that your forecasts will be wrong it is a good way to demonstrate to your investors that you are thinking about your business in the right way. Check out why Gale Wilkinson of Vitalize Ventures likes to see early-stage founders model their future below:

A few other items that might be worth including with your financials can be found below:

- Include revenue

- Major expenses

- Salaries

- Financial goals and milestones

Related Resource: 4 Types of Financial Statements Founders Need to Understand

Related Resource: A User-Friendly Guide on Convertible Debt

Share Your Business Plans With Visible

Once you have your business plan in place it is time to hit the ground running and collect feedback on your business plans and objectives. Use our Update and Deck sharing tools to share your plans with potential investors and stakeholders along the way. Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.