With a recovery in full swing within the travel and tourism industry, it’s time to get back to business to meet people’s wanderlust desires. Now that things are opening up again people are more excited than ever to travel and have experiences.

Julia Simpson, president and CEO of WTTC (The World Travel & Tourism Council) says “Our latest forecast shows the recovery significantly picking up this year as infection rates subside and travelers continue benefiting from the protection offered by the vaccine and boosters. As travel restrictions ease and consumer confidence returns, we expect a welcome release of pent-up travel and tourism demand.”

Businesses have managed to survive through innovative new marketing tactics which encouraged people to travel locally and pivots to accommodate limitations. This is how Airbnb managed to overcome the toughest times of the pandemic. Their marketing strategy encouraged people to get out of the house and explore areas around them.

According to TechCrunch “High-profile funding rounds also appear to be popping up across travel and hospitality’s various sub-sectors, including bookings, activity marketplaces, short-term rental, tourism and hotel platforms. And companies are continuing to pull in funding rounds in the hundreds of millions to billion-dollar range.”

The pandemic gave rise not only to a new way of traveling but also changed the way people want to travel and gave them new opportunities to do so. Investments in alternative accommodation startups and other businesses in this area have been on the rise and seems as though the trend will continue from 2021.

With remote work now being an option to the majority of people, we’re seeing new huge growth opportunities for coworking, coliving, and traveling. Companies like HiveGeist launched last year to offer travelers stylish modern accommodations and offer a place to meet and work with other digital nomads. PhocusWire reports “other significant rounds have gone into vacation home co-ownership startup Pacaso with $125 million and Outdoorsy with $120 million while luxury rental company Kocomo with $56 million, Holidu with $45 million and Getaway with $42 million, also benefited from excitement in the segment.”. Along with large investments going to alternative accommodation, hotel technology companies have also received considerable interest from VC’s.

Skift’s report on Venture Investment Trends in 2022, revealed that “travel startups raised $8.6 billion last year, a figure that’s 90 percent of 2019 levels and a 73 percent increase from 2020.” and we predict this will continue to be on the rise. As well CNN reported, “travel and tourism could generate $8.6 trillion globally this year, according to new research by the World Travel & Tourism Council. That’s just 6.4% below pre-pandemic levels.”

According to the World Travel & Tourism Council:

- U.S. domestic Travel & Tourism spending is forecast to reach more than $1.1 trillion for the year, surpassing pre-pandemic levels by 11.3%

- International traveler spending in the U.S. could see growth of $113 billion, compared to 2020, reaching nearly $155 billion, slightly below (14%) 2019 levels

- Employment in the sector could also surpass pre-pandemic levels, reaching nearly 16.8 million jobs, above pre-pandemic levels by almost 200,000 jobs

Journey Ventures

- Location: Israel

- About: Journey Ventures is a multi-stage VC dedicated to the booming Travel Tech industry. Travel is one of the world’s fastest-growing sectors. Travel startups of the last few years have already disrupted some of the largest sectors in our industry, a momentum we expect to continue. This large market of ever-increasing Travel Tech offerings is ready for smart investments, and Journey Ventures is an expert in the field.

- Thesis: Our goal is to develop a portfolio of Israeli and international companies specializing in the fields of tourism, travel Tech and the hotel industry that have reached an advanced stage of technological development.

- Investment Stages: Pre-seed, Seed, Series A, Series B, Series C

- Recent Investments:

- Wenrix

- UpStay

- Roomerang LTD

To learn more about Journey Ventures, check out their Visible Connect Profile.

Related Resource: 9 Active Venture Capital Firms in Israel

MairDuMont Ventures

- Location: Stuttgart, Germany

- About: MAIRDUMONT VENTURES is the venture capital arm of the MAIRDUMONT Group and has been supporting digital travel companies in their future growth since 2015. MAIRDUMONT VENTURES uses its unique sector focus “Travel” to dive deeply into different business models and to evaluate potentials together with our portfolio companies. We have extensive know-how and can leverage the huge network of the MAIRDUMONT Group – with well-known brands such as Marco Polo, DuMont, Baedeker, Kompass or Falk – to offer our portfolio companies not only financial resources, but also strategic and operational support. We invest in fast-growing, early-stage and innovative companies that revolutionize travel. These can be solutions for end customers (B2C) as well as business customers (B2B).

- Recent Investments:

- zizoo

- holidu

- Paul Camper

To learn more about MairDuMont Ventures, check out their Visible Connect Profile.

Related Resource: 8 Active Venture Capital Firms in Germany

JetBlue Technology Ventures

- Location: San Carlos, California, United States

- About: JetBlue Technology Ventures invests in and partners with early stage technology startups improving the future of travel and hospitality.

- Thesis: We invest in and partner with early stage startups improving travel and hospitality.

- Investment Stages: Seed, Series A, Series B, Growth

- Recent Investments:

- NLX

- FLYR Labs

- Bizly

To learn more about JetBlue Technology Ventures, check out their Visible Connect Profile.

500 Startups

- Location: Mountain View, California, United States

- About: 500 Startups is a global venture capital firm with a network of startup programs headquartered in Silicon Valley.

- Thesis: Uplifting people and economies through entrepreneurship

- Investment Stages: Seed, Series A

- Recent Investments:

- Tripoto

- Wandero

- Flightfox

To learn more about 500 Startups, check out their Visible Connect Profile.

Fifth Wall

- Location: Venice, California, United States

- About: At Fifth Wall we are pioneering an advisory-based approach to venture capital. Full-service, integrated, operationally aligned. We are the first and largest venture capital firm advising corporates on and investing in Built World technology. Our strategic focus, multidisciplinary expertise, and global network provide unique insights and unparalleled access to transformational opportunities.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Loft

- Flyhomes

- Smart Rent

To learn more about Fifth Wall, check out their Visible Connect Profile.

Thayer Ventures

- Location: Valencia, California, United States

- About: Thayer Ventures invests in Travel Technology.

- Thesis: We invest in early-stage travel and transportation technology.

- Investment Stages: Seed, Series A

- Recent Investments:

- Beekeeper

- Snapcommerce

- Swiftmile

To learn more about Thayer Ventures, check out their Visible Connect Profile.

Structure Capital

- Location: San Francisco, California, United States

- About: Structure Capital help passionate teams build great companies by investing seed-stage capital, time, experience and relationships.

- Investment Stages: Seed, Series A, Series B, Growth

- Recent Investments:

- Sonder

- CANOPY

- Unbabel

To learn more about Structure Capital, check out their Visible Connect Profile.

Portugal Ventures

- Location: Porto, Lisboa, Portugal

- About: Portugal Ventures is a venture capital firm that invests in seed rounds of Portuguese startups in tech, life sciences, and tourism.

- Thesis: We invest in companies in the seed and early stages operating in the digital, engineering & manufacturing, life sciences and tourism sectors.

- Investment Stages: Pre-Seed, Seed, Series A

- Recent Investments:

- DefinedCrowd

- Relive

- Sleep & Nature

To learn more about Portugal Ventures, check out their Visible Connect Profile.

aws Gründerfonds

- Location: Vienna, Wien, Austria

- About: Venture Capital for Ideas and Innovations aws Founders Fund invests venture capital during the start-up and early growth phase of Austrian start-ups. We offer support for your future (financial) plans as a long-term investor and partner and believe in the additional value of co-investments.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Innerspace

- Rendity

- CheckYeti.com

To learn more about aws Gründerfonds, check out their Visible Connect Profile.

VentureFriends

- Location: Athens, Attiki, Greece

- About: VC fund based in Athens but investing across Europe, we focus on FinTech, Travel, PropTech, B2C & Marketplaces. We are entrepreneurial investors, with strong experience, network and track record. We have been entrepreneurs, founders, worked at startups or angel investors in early stages and have a founder first & value driven approach

- Thesis: We are entrepreneurial investors who love to support startups and help them become impactful companies with a worldwide presence.

- Investment Stages: Seed, Series A, Series B, Series C, Growth

- Recent Investments:

- Blueground

- Home Made

- Welcome Pickups

To learn more about VentureFriends, check out their Visible Connect Profile.

Travel Impact Lab

- Location: Utrecht, Netherlands

- About: Travel Impact Lab helps start-ups to get started and sets existing travel organizations in motion.

- Investment Stages: Accelerator

To learn more about Travel Impact Lab, check out their Visible Connect Profile.

Gobi Partners

- Location: Shanghai, China

- About: Gobi Partners is an early stage to late stage venture capital firm focusing on IT and digital media investments in China, HK and ASEAN.

- Investment Stages: Seed, Series A, Series B, Series C

- Recent Investments:

- Julo

- Carsome

- Travelio

To learn more about Gobi Partners, check out their Visible Connect Profile.

Travel Capitalist Ventures

- Location: Irvine, California, United States

- About: Travel focused Venture Capital and Private Equity Investor.

- Thesis: We identify, invest and help travel companies rapidly and sustainably expand.

- Investment Stages: Seed, Series A, Growth

- Recent Investments:

- Jetsmart

- Voopter

- Guiddoo

To learn more about Travel Capitalist Ventures, check out their Visible Connect Profile.

Alstin Capital

- Location: Munich, Bayern, Germany

- About: Alstin Capital is an independent venture capital fund based in Munich. We invest in rapidly growing technology companies that have the potential to leverage the significant market potential of the future and become market leaders. We not only invest in convincing technology, but above all in the entrepreneurs behind the technology. We support our entrepreneurs with capital and know-how so that they can grow faster and more successfully. Our investment is based on the conviction that entrepreneurial know-how, many years of transaction experience, international networks and sales excellence are the success factors for sustainable growth. Our team brings a variety of complementary strengths to help make any investment a success.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Pilant

- Neodigital

- Circula

To learn more about Alstin Capital, check out their Visible Connect Profile.

TruVenturo

- Location: Hamburg, Germany

- About: We believe venture capital will make the best returns if you invest in the big future markets. Therefore we are strong believers in Tech (managed by Norbert Beck), Brain Computer Interface (managed by Florian Haupt) and pharma to prevent age related disease and prolong healthy human lifespan managed by Nils Regge with the investment vehicle Apollo.vc.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Dreamlines

- HAPPYCAR

- DreamCheaper

To learn more about TruVenturo, check out their Visible Connect Profile.

Howzat Partners

- Location: London, England, United Kingdom

- About: We are looking to invest in and build internet businesses that have a “HOWZAT” factor. This may sound a little trite; but we see major changes caused by the internet and the opportunities are genuinely exciting. The right idea; the right business; the right time; should generate the “HOWZAT” feeling. David felt it when he came across Cheapflights and was involved in acquiring the Company in 2000. We are seeking the same feeling again in the investments we make.

- Investment Stages: Seed, Series A

- Recent Investments:

- Trivago

- LODGIFY

- otelz.com

To learn more about Howzat Partners, check out their Visible Connect Profile.

Slow Ventures

- Location: San Francisco, California, United States

- About :Slow Ventures invests in companies central to the technology industry and those on the edges of science, society, and culture.

- Thesis: Slow Ventures invests in companies central to the technology industry and those on the edges of science, society, and culture.

- Investment Stages: Seed, Series A

- Recent Investments:

- Scout

- Vamo

- Hipcamp

To learn more about Slow Ventures, check out their Visible Connect Profile.

Start Your Next Round with Visible

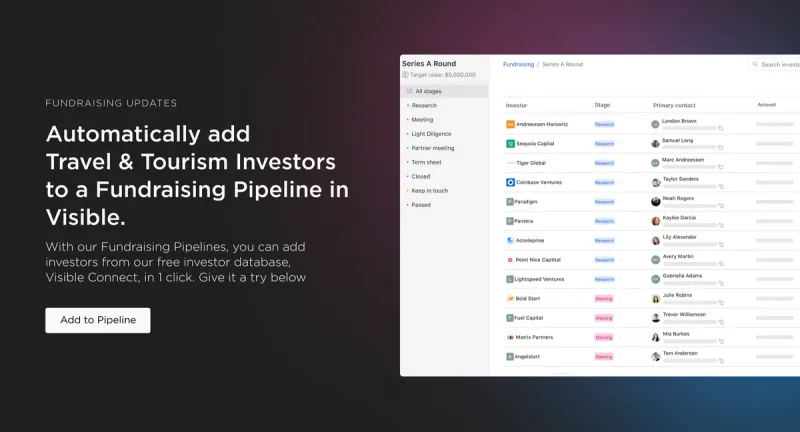

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our D2C investors here and e-commerce here.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors and How to Cold Email Investors: A Video by Michael Seibel of YC.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.