At Visible, we like to compare a venture fundraise to a traditional B2B sales and marketing funnel.

- At the top of your fundraising funnel, you are trying to add qualified investors via warm and cold outreach.

- In the middle of your fundraising funnel, you are nurturing potential investors with meetings, pitch decks, monthly updates and more.

- At the bottom of your fundraising funnel, you are working through due diligence and turning potential investors into new investors.

Related Resource: The 12 Best VC Funds You Should Know About

Like a traditional B2B sales and marketing process, you need to find qualified “leads” (AKA investors) to fill the top of your funnel. If you’re located in Atlanta, check out our list of investors in the area below:

1. Panoramic Ventures

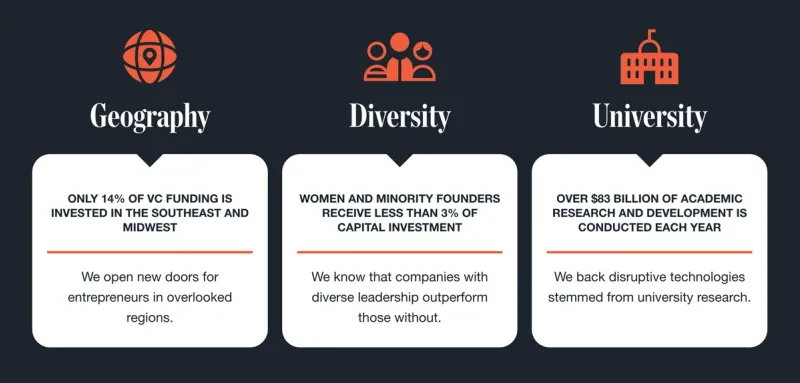

As put by their team, “Panoramic Ventures opens new doors for founders, giving more entrepreneurs access to capital to build leading tech companies. We are building on our decades of experience as founders and investors to support underserved geographies and overlooked founders.”

Focus and industry: Panoramic Ventures is industry agnostic and primarily invests in companies located in the Southeast and Midwest (US).

Funding stage: Panoramic does not clearly state their funding stage focus

As put by the team at Panoramic, “In 2021, BIP Capital and Paul Judge joined forces to launch Panoramic Ventures. A VC firm that would take a wider view approach, opening new doors for overlooked founders, giving more entrepreneurs access to capital to build leading tech companies. Panoramic Ventures is the largest tech venture fund headquartered in the Southeast.”

Some of their notable investments include:

- Base

- Vibenomics

- UserIQ

Location: Atlanta, GA

Learn more about Panoramic Ventures by checking out their Visible Connect profile here →

2. Engage

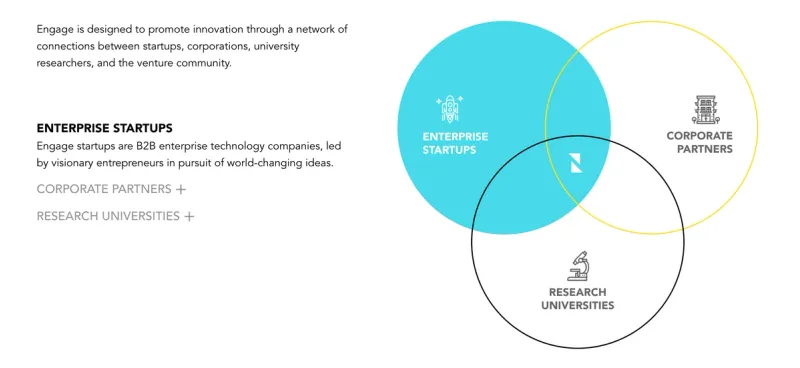

As put by their team, “Engage is a first-of-its-kind innovation platform comprised of category-leading corporations in the Southeast that have joined forces to support startups building the future of enterprise.”

Focus and industry: Engage focuses on B2B enterprise companies. They have 6 strategic themes within B2B enterprise — “Customer Experience, Supply Chain & Manufacturing, Future of Work, Big Data, Analytics, & Security, Logistics & Mobility, and Climate Tech & Sustainability.”

Funding stage: According to their Visible Connect Profile, Engage invests in Seed through Series B stages

According to their team, “Engage is an enterprise venture platform that counts 11 of the country’s largest corporations as investors. We invest in enterprise and frontier technology informed by insights from our corporate partners.”

Some of their popular investments include:

- Fast Radius

- MetaCX

- Paladin

- ThingTech

Location: Atlanta, GA

Learn more about Engage by checking out their Visible Connect profile here →

3. Forté Ventures

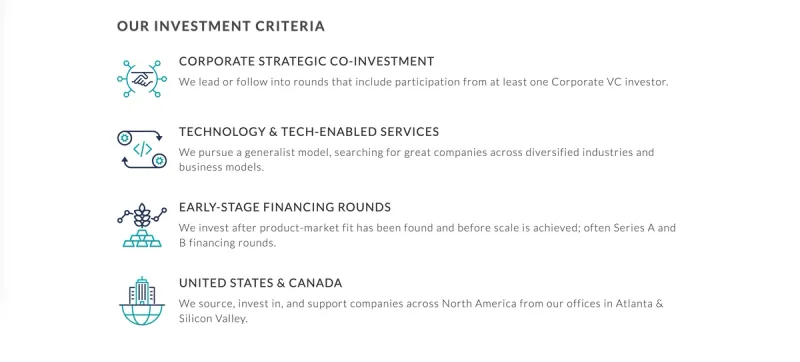

As put by their team, “Forté Ventures is an institutional venture capital firm uniquely focused on collaborating and co-investing with Corporate Venture Capital groups. We believe that the right corporate strategic investors can act as a force multiplier for startups, and we work alongside our corporate partners to ensure the realization of those benefits.”

Focus and industry: As put by their team, “We pursue a generalist model, searching for great companies across diversified industries and business models.”

Funding stage: The team at Forté looks for companies that have found product market fit and have yet to scale — typically series A and series B.

As put by their team, “Our focus and experience allow us to help entrepreneurs navigate the complexities of corporate investment, while also enabling us to serve as trusted partners to both our portfolio companies and our syndicate partners.”

Some of their popular investments include:

- Urgently

- Integrate

- Springbot

Location: Atlanta, GA and Sunnyvale, CA

Learn more about Forté Ventures by checking out their Visible Connect profile here →

4. Fintech Ventures Fund

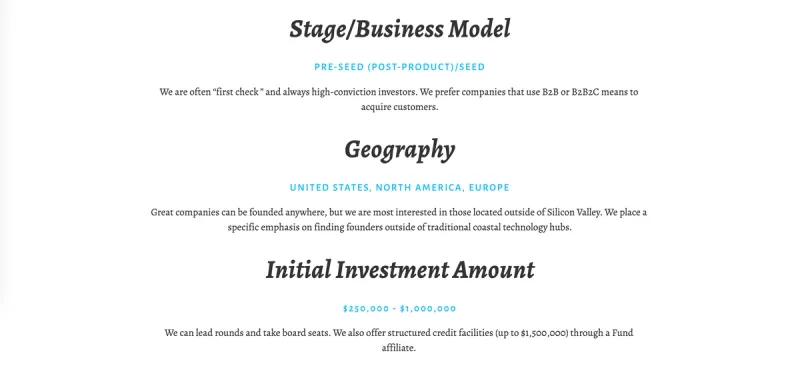

As put by the team at Fintech Ventures Fund, “We are hyperfocused on investing in founders building disruptive early-stage fintech and insurtech companies.”

Related Resource: FinTech Venture Capital Investors to Know

Focus and industry: The team at Fintech Ventures Fund is focused on fintech and insurtech companies.

Funding stage: The team is focused on pre-seed and seed stage investments. They typically write checks anywhere between $250k and $1M.

As put by their team, “Our primary mission is to forge strategic partnerships with entrepreneurs and provide them with the resources and support they need to build successful businesses.

Following our Fund’s initial investment, our portfolio company founders have secured over $1 billion in cumulative equity and debt financing from leading institutional co-investors.”

Some of their most popular investments include:

- Groundfloor

- Marble

- Vero Technologies

Location: Atlanta, GA

5. Tech Square Ventures

As put by their team, “Tech Square Ventures is an Atlanta-based early-stage venture capital firm. We partner with visionary entrepreneurs and help them with what they need most – access to markets and customers.”

Focus and industry: The team at Tech Square Ventures is focused on B2B (enterprise), Marketplace, Tech-enabled services, and university spinouts.

Funding stage: Tech Square Ventures is focused on early stage startups.

As put by their team, “We believe the best part of what we do is the privilege of working with exceptional founders. We invest in the early stages of company development, partnering with entrepreneurs building transformative companies and continuing as committed partners through the journey of building a successful business.”

Some of their most popular investments include:

- The Mom Project

- Paladin

- MetaCX

Location: Atlanta, GA

Learn more about Tech Square Ventures by checking out their Visible Connect profile here →

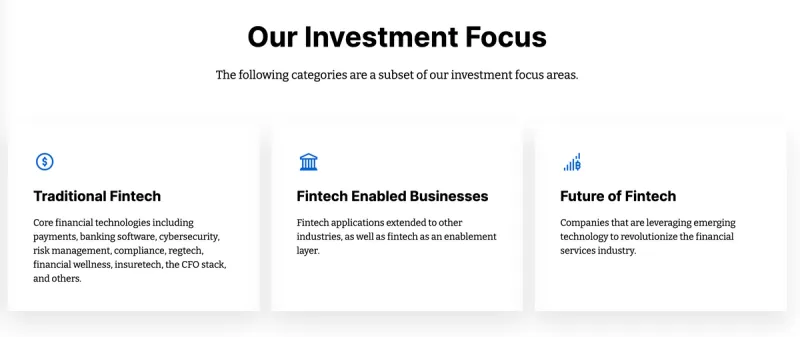

6. TTV Capital

As put by their team, “TTV Capital is one of the first and only early-stage venture capital firms focused exclusively on investing in companies in the financial services ecosystem. We’ve been a driving force in fintech since before the sector was defined.”

Focus and industry: TTV Capital is focused on companies in the financial services ecosystem. TTV also has the following subset focus areas:

Funding stage: The team at TTV Capital is focused on early-stage investments

TTV has been investing for multiple decades so their portfolio spans many markets and generations of fintech companies. Check out some of their most popular investments below:

- Bitpay

- Greenlight

- Cardlytics

Location: Atlanta, GA

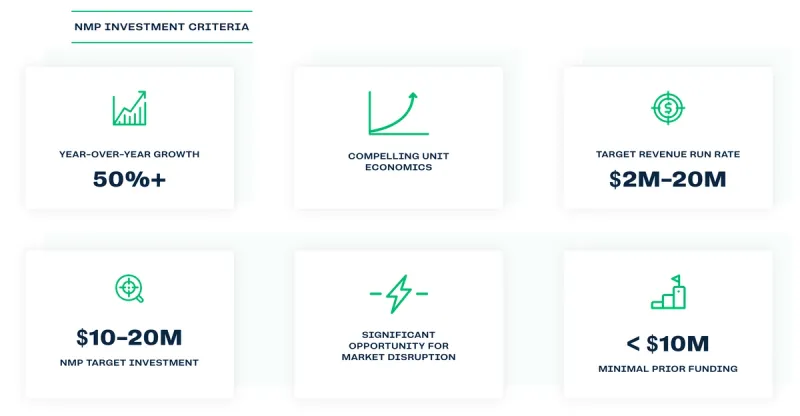

7. Noro-Moseley Partners

As put by their team, “At NMP, our investment philosophy is centered squarely on the entrepreneurs with whom we partner. In addition to capital, the firm’s goal is to provide energy, connections and domain expertise to strong entrepreneurs in order to help them succeed.”

Focus and industry: As written by their team, “NMP is vertically-focused within the information technology and healthcare markets.”

Funding stage: NMP typically looks for companies with a $2M-20M run rate and will write checks between $10M and $20M.

Some of NMP’s most popular investments include:

- Red Canary

- Revenue Analytics

- UpwardHealth

Location: Atlanta, GA

8. Fulcrum Equity

As put by their team, “Fulcrum Equity Partners manages over $600 million and makes equity investments in rapidly growing businesses that are led by strong entrepreneurs and management teams.

We target companies within the healthcare, B2B SaaS, and technology-enabled services industries. We provide financing to meet a wide range of needs including internal growth initiatives, acquisitions, shareholder liquidity, buy-outs, recapitalizations, and divestitures.”

Focus and industry: Fulcrum Equity is focused on companies within healthcare, B2B SaaS, and tech-enabled service industries.

Funding stage: Fulcrum typically writes checks between $5M and $30M

Fulcrum’s criteria slightly differ depending on the industry of the company. You can learn more about their investment criteria here.

Some of their most popular investments include:

- Olio

- Avant-Garde

- HomeFirst

Location: Atlanta, GA

9. Atlanta Ventures

As put by the team at Atlanta Ventures, “We are focused on serving entrepreneurs in earlier stages (<$5M ARR). We offer a unique community in partnership with the Atlanta Tech Village. We have an exclusive focus on fast growing companies in the Southeast region.

Our team has direct operating experience as successful entrepreneurs, product leaders, and deal advisors. We typically lead or fill the entire round with an investment of $250K to $5M, and we built the Studio for entrepreneurs looking to launch with us at the absolute ground floor of their business.”

Focus and industry: Atlanta Ventures has a focus on SaaS and subscription businesses.

Funding stage: Atlanta Ventures will invest in any stage from seed to series B.

As they put it, “After achieving Product/Market fit, you may even find yourself well on your way to hitting a milestone very few companies ever reach: $1M in ARR. We love partnering with entrepreneurs at this stage of the journey. “

Some of Atlanta Ventures most popular investments include:

- Calendly

- Salesloft

- Terminus

Related Resource: 24 Top VC Investors Actively Funding SaaS Startups

Location: Atlanta, GA

Learn more about Atlanta Ventures by checking out their Visible Connect profile →

Network with investors today with Visible

At Visible, we oftentimes compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

Related Resource: A Quick Overview on VC Fund Structure

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.