Case Study: How Moxxie Ventures uses Visible to increase operational efficiency at their VC firm

About Moxxie

Moxxie was founded in 2019 by former Twitter executive Katie Stanton. Prior to starting Moxxie Katie worked at Google, in the Obama administration as a Special Advisor to the Office of Innovation, and co-founded the angel group #Angels. In 2021, Katie brought on Alex Roetter, whom she had worked with before at both Twitter and Google, as an equal partner in Moxxie’s second fund of $85M. Alex joined Moxxie with a wealth of operational and engineering experience from previously serving as the Senior VP of engineering at Twitter for 6 years as well as working as a software engineer at Google and various other early-stage startups.

Today, Moxxie has invested in over 60+ seed-stage companies in the consumer, enterprise, fintech, health tech, and climate sectors. The team at Moxxie is differentiated by their operational experience and focus on underrepresented founders. According to an article published in Forbes, out of the 27 investments from Moxxie’s first fund, 36% were founded by women, 40% by people of color, 8% by Black founders and 43% by immigrant founders. Learn more about Moxxie.

This Case Study was put together in collaboration with Alex Roetter, Managing Director and General Partner at Moxxie.

What Moxxie was doing prior to using Visible

In the early days at Moxxie, the team used a combination of check-in calls at varying frequencies, ad-hoc meetings, and texts to gather updates from their companies. Later on, they created a Google Group email alias where founders sent their updates so the communications were all stored in one inbox. The Moxxie team kept a summary of each company in a combined Google Document that was updated irregularly.

The portfolio monitoring challenges Moxxie was facing

The main issue with Moxxie’s ad-hoc method was that “...it was just all very manual. It was a mish-mash of documents and hard to maintain. We were inconsistent in how up-to-date we were on different companies,” shared Alex, Moxxie’s Managing Director. The manual effort required to stay on top of portfolio companies meant portfolio monitoring was “...falling to the wayside and we were not doing as good of a job [monitoring our companies] as we needed to be.”

“...it was just all very manual. It was a mish-mash of documents and hard to maintain. We were inconsistent in how up-to-date we were on different companies."

It’s common for investors to feel overwhelmed as they attempt to manually keep up to date on a growing number of portfolio companies despite recognizing the benefits of doing so.

Alex emphasized that the main reason Moxxie wanted to improve their portfolio monitoring was to ensure they were spending their time most effectively at their firm. It was hard to identify which companies needed their support and where Moxxie's time would be most valuably spent “...without having a regular heartbeat from [their] portfolio companies.”

The reasons Moxxie chose Visible

Moxxie’s founder Katie Stanton was told to check out Visible’s KPI tracking capabilities at the end of 2022 while she was attending the Equity Summit, an invitation-only gathering that brings together thought-leading LPs and GPs that drive industry change.

Alex from Moxxie reached out to Visible soon after the initial referral to schedule a demo. The demo confirmed that the Visible platform had exactly what Alex was looking for in a portfolio KPI tracking tool.

Moxxie's portfolio monitoring criteria included:

- An automated way to send structured data requests to portfolio companies

- A solution that wasn’t taxing on their founders

- Allowed founders to share their data within seconds

- Ability to see all their portfolio data in one clear place

- Ability to easily build Tear Sheets for each company

Moxxie's onboarding experience with Visible

Moxxie’s onboarding took approximately 9 days to complete. When asked to share feedback on Visible’s onboarding process Alex shared “Everything was great. Whenever we had bulk data in a CSV that needed to be uploaded we shared it with Visible and it was uploaded within 24 hours.”

Check out additional Visible reviews on G2.

How Moxxie is leveraging Visible to streamline portfolio monitoring and reporting processes today

Today Moxxie doesn’t have to remember to check in with their companies or make guesses about their companies’ recent progress updates. Instead, Visible has enabled Moxxie to send automatic, recurring, structured data requests to their companies that can be completed without their founders ever having to log in or create an account. The Moxxie team is immediately notified when companies complete data Requests. From there, they are able to easily identify which companies need more support. This streamlined, founder-friendly process ensures the Moxxie team can continue to spend time on high-value fund operations, such as deal flow, while also efficiently monitoring and supporting current portfolio companies.

Taking a closer look at Moxxie’s use of the Visible platform, the team primarily uses four main features on Visible: Requests, Tear Sheets, Reports, and Updates.

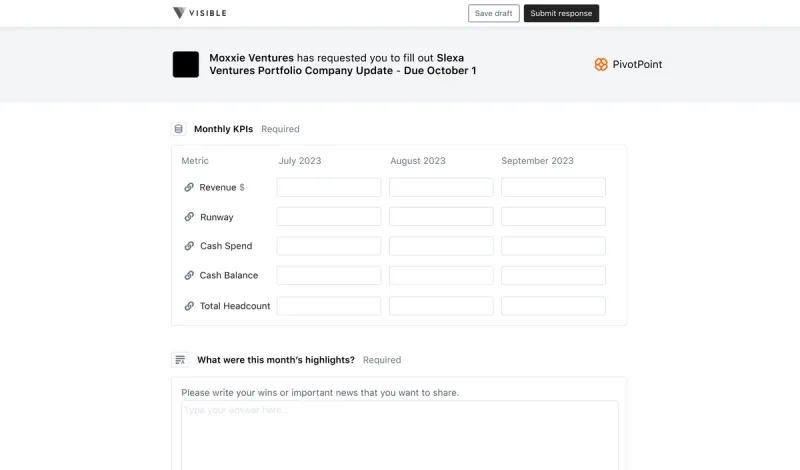

Requests: Streamlining Moxxie’s portfolio KPI data collection process

Moxxie uses Visible’s Request feature to collect 5 metrics from companies on a regular basis. The firm collects data from early-stage companies on a monthly basis and on a quarterly basis for more mature companies in their portfolio.

The five metrics Moxxie collects include:

- Revenue

- Runway

- Cash Spend

- Cash Balance

- Headcount

Moxxie also includes a qualitative text block in their Request that provides companies with an opportunity to add additional context to their metrics, share any additional updates, or ask Moxxie for support on specific items.

Alex shared that likes that the Visible platform sends him a notification each time a company submits a Request. He uses this as an opportunity to quickly identify any changes to the company’s performance. Alex shared “...anytime there’s something unexpected it’s a reminder to check in with the company.”

Reports: Building a custom investment data report before an annual meeting

Another key feature that Moxxie is utilizing is Visible’s report feature which allows Moxxie to pull together select metrics and investment data into a single table view. Moxxie has a fund summary for both Fund I and Fund II that includes: initial ownership %, total invested, total invested from a specific fund, and the initial valuation for each company.

Moxxie initially created this report to prepare for an annual meeting with LPs. They wanted to see the numbers across all their portfolio companies, be able to download the figures, and then compute averages.

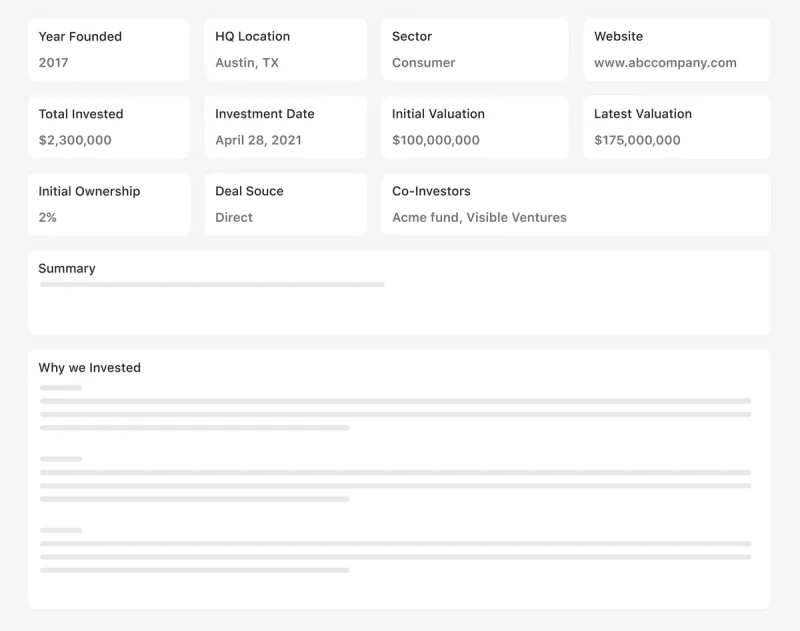

Tear Sheets: Creating a clear overview of individual company performance

Moxxie utilizes Visible’s dashboard templates to create custom Tear Sheets for each of their companies. Moxxie’s Tear Sheets incorporate elements of their original investment memo coupled with dynamic metrics and qualitative updates that change over time.

Integrating company properties into Tear Sheets

The static information in Moxxie's Tear Sheets is pulled directly from companies' profiles in Visible.

The information that Moxxie includes in their Tear Sheets are:

- Company website url

- Latest valuation

- Co-investors

- Founders

- Company summary

- Why we invested

- Status

- Deal source

- Initial ownership

- Initial valuation

- Investment date

- Total invested

- Sector

- HQ location

- Year founded

Integrated dynamic charts into Tear Sheets

Moxxie also incorporates data visualizations into their Tear Sheets which are automatically updated as companies submit new information to Visible. The dynamic information Moxxie includes in Tear sheets is:

- Monthly KPI’s in a bar chart

- Runway vs Headcount in a bar chart

- Monthly spend vs cash balance in a bar chart

- Revenue forecast vs actual in a bar chart

- Update/progress since investment in a text widget

- Key metrics in a text widget

- Company-specific metrics in a text widget

View Tear Sheet examples from Visible.

Updates: Communicating portfolio performance with LPs on a quarterly basis

Moxxie also leverages Visible’s Updates feature to send outbound communication to their LPs and the wider Moxxie community on a quarterly basis. The firm uses Visible’s Update feature instead of its previous Google Group as a way to consolidate its tech stack. Alex shares that he finds the open rates and viewing analytics helpful so he can understand how LPs are engaging with their regular communications.

Conclusion

Moxxie chose to move forward with Visible’s founder-friendly portfolio monitoring solution after hearing about Visible’s KPI tracking capabilities through a credible referral. By adopting Visible, Moxxie’s ad-hoc, manual portfolio monitoring processes have been transformed into a streamlined cadence for collecting structured updates from their companies. The firm previously stored outdated company summaries in Google Documents and now the Moxxie team leverages neatly organized Tear Sheets that auto-update when companies share new information.

Over 400+ VC firms are using Visible to streamline their portfolio monitoring and reporting process.