Before, media and entertainment largely revolved around large corporations and conglomerates creating, producing, and distributing content to the masses. Today, technology has democratized content creation and distribution, allowing individuals — or creators — to produce and share their work directly with their audience. Now with the help of AI they can scale their operations and improve their output- presenting opportunities for founders to create solutions to help serve the Media industry as well.

How AI is Reshaping Media & Entertainment for Founders

In the constantly evolving media and entertainment industry, one trend has dramatically accelerated change: artificial intelligence (AI). This revolutionary technology has transformed the landscape, opening unprecedented opportunities for founders and startups. AI not only augments content creation but also pioneers disruptive business models, prompting a fundamental shift in the industry’s dynamics.

AI’s integration into the media and entertainment industry has automated processes, improved personalization, and catalyzed content democratization. Its capabilities have broken down barriers, allowing creators and founders to produce content more efficiently and distribute it to audiences on a scale that was previously unimaginable.

AI enables advanced data analysis, equipping companies with a deep understanding of their audiences. Founders can leverage this data to deliver highly personalized content, driving engagement and fostering loyalty among consumers. Moreover, AI’s predictive capabilities enable advanced trend forecasting, helping startups stay ahead of the curve.

AI and Media Creation

The introduction of AI has dramatically improved visual effects, enabling filmmakers to create incredibly realistic and complex visuals, previously thought unachievable. Cutting-edge developments, such as deep fake technology and de-aging actors digitally, have opened up new realms of possibilities.

The impact of AI is not only limited to visuals but also extends to improving operational efficiency within the industry. It has made traditionally cumbersome tasks like post-production, budgeting, scheduling, and archiving more efficient. This transition not only allows filmmakers greater control over the production process but also leads to substantial savings in both time and cost.

Generative AI, a subset of AI, has further revolutionized content creation. This technology can generate text, music, videos, and even virtual realities that feel authentic and human-like. OpenAI’s GPT-3, for instance, can write articles, answer questions, translate languages, and even create poetry, significantly reducing the time and effort required in the content creation process.

As a founder, this presents enormous possibilities. With generative AI, you can automate routine content creation, allowing your team to focus on strategic and creative tasks. It also makes content production more cost-effective, removing the need for large content creation teams and facilitating rapid scaling of content output.

Related resource: Emerging Giants: An Overview of 20 Promising AI Startups

Gaming

Gaming is having a profound impact across the entire media and entertainment industry. Any entertainment strategy should also consider video games, from in-app gamification, to simple mobile games to large-scale multiplayer services and hyper-realistic game worlds. Gaming also highlights the potential of tight-knit communities and fandoms in sustaining and amplifying entertainment franchises. In 2023, it’s expected to become increasingly clear that video, social, messaging, and interactive gaming are all part of the same ecosystem of engagement.

Solutions for Creators

Karat financial raised $40M Series B, led by SignalFire. This has been one of the largest fund rounds to date this summer. Karat financial provides tax and bookkeeping services to content creators and they are the first business credit card for creators.

The Creator Economy’s Impact on the Media Industry

Before, media and entertainment largely revolved around large corporations and conglomerates creating, producing, and distributing content to the masses. Today, technology has democratized content creation and distribution, allowing individuals — or creators — to produce and share their work directly with their audience.

The creator economy has ushered in a new era in the media and entertainment industry, transforming it from a mass-production model to a more personalized and individual-driven one. This shift has significant implications for founders looking to thrive in this new landscape.

The Creator Economy Ecosystem spans various platforms and forms of media, including video (YouTube, TikTok), audio (Spotify, SoundCloud), writing (Medium, Substack), and even gaming (Twitch, Roblox). Their content is not just consumed passively; it sparks interactions, fosters communities, and forms a more engaged and connected audience.

Distribution Models

Digital distribution models have also undergone a massive transformation. Previously, content was primarily distributed via a single platform or channel. Now, a multi-platform approach has become critical, reaching the audience where they are – whether that’s Instagram, Twitter, TikTok, or a website.

Audience Engagement

Now audiences respond more to influencers and creators because they can identify with them more or these people speak more to a specialized niche.

Impacts on the Media & Entertainment Landscape

- Disintermediation: Now anyone can bypass traditional media gatekeepers. This direct-to-consumer approach allows people to maintain control over their content, monetize it more effectively, and establish a more intimate connection with their audience.

- Diversification of Revenue Streams: People can now generate revenue through a combination of ad revenues, merchandise sales, paid subscriptions, crowdfunding, and brand partnerships.

- Rise of Niche Content: As we’ve seen people who can cater to specific interests and communities, have seen huge success. This targeted content can foster a loyal and engaged audience, offering lucrative opportunities for advertisers and marketers.

Related Resource: Top VCs Investing in the $100 Billion Creator Economy

Opportunities For Founders within the Media & Creator Industry

The shift in Media and Entertainment has left several areas of potential high yield for founders willing to provide services to this rapidly expanding industry.

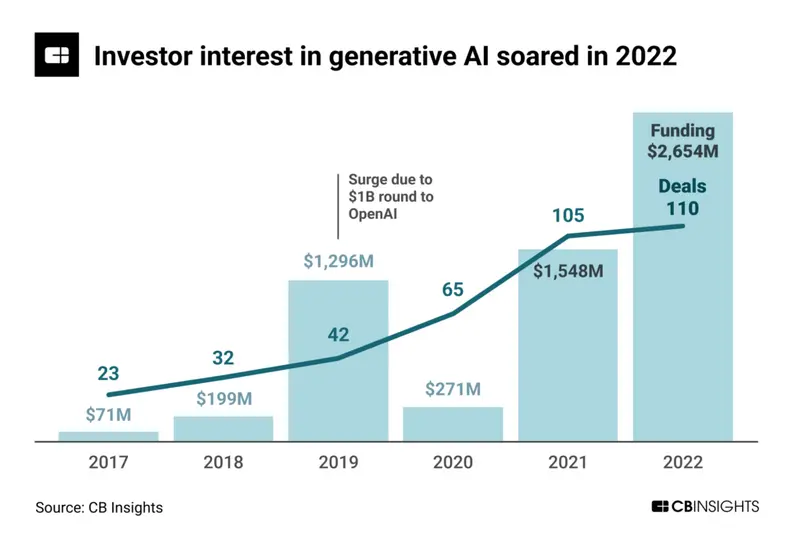

CBInsights reported the year’s largest rounds:

- Anthropic, an AI model developer and research outfit ($580M Series B)

- Inflection AI, which focuses on human-computer interfaces ($225M Series A)

- Cohere, a developer-focused NLP toolkit ($125M Series B)

- Jasper, an AI-powered content creation suite ($125M Series A)

And so far these are the 6 companies that have reached unicorn status (valued at $1B+), including:

Areas that founders can develop to help creators monetize and produce:

- Platform Development: Founders can build platforms that empower creators, providing them with the tools they need to create, distribute, and monetize their content.

- Some companies include Circle for paid communities, ConvertKit a marketing hub for creators that helps you grow and monetize your audience, and OnlyFans an internet content subscription service.

- Creator Tools: Creators are always looking for tools that can make their work easier, whether that’s content creation software like Canva, analytics platforms, scheduling tools like Later, or collaboration software like figma.

- Creator Services: Founders can offer services aimed at helping creators grow and manage their businesses, such as analytics, marketing, legal services, or financial management. Companies like Pex (music rights management) and Jellysmack (video optimization) are already doing this.

Creators As Customers

Creators’ willingness to spend money on tools and services, is also associated with the kind of creator that is viewing their work as a business. They understand that investing in high-quality tools and services can help improve the quality of their content, expand their reach, and ultimately increase their income. The key for founders is to ensure that the value provided by their product or service is clear and that it meets a real need in the creator community.

Ultimately, the potential for profitability in the creator economy is significant, but success requires an understanding of the unique needs and challenges of creators. Founders looking to serve this industry must focus on delivering real value to creators, whether that’s by making the content creation process easier, helping creators reach a wider audience, or providing new ways for creators to monetize their work.

Engagement Trends

In the 2023 outlook by Deloitte, these are the central trends set to create a new engagement ecosystem in the media and entertainment industry. Streaming video, social media, and gaming are no longer individual sectors but interconnected parts of a more extensive system. As these sectors become more interdependent, the most successful companies will be those that cultivate robust cross-sector visions that drive their industries forward. In 2023, it’s expected to become increasingly clear that video, social, messaging, and interactive gaming are all part of the same ecosystem of engagement.

Critical trends are reshaping the sector:

- Interconnectedness: Streaming video, social media, and gaming are converging into a unified ecosystem. The companies likely to succeed will develop strategies that incorporate all these elements.

- Constant Change: With increased competition from various fronts, businesses in the industry, particularly studios and streaming services, must adapt swiftly and continuously to retain their market positions.

- User-Generated Content (UGC): Top social media platforms are emphasizing UGC, blurring the lines between social networking and personalized TV. While this boosts audience engagement, it presents challenges in terms of managing content volume and monetizing the creator economy.

- The Gaming Influence: Gaming is having a profound impact across the entire media and entertainment industry. Any strategy in the sector must now consider the role of gaming, from simple mobile games to complex multiplayer services.

Key Takeaways for Founders:

- Think in Ecosystems: Develop strategies that intertwine streaming, social media, and gaming rather than treating them as separate entities.

- Stay Agile: Be prepared for continuous change and disruption. Constantly adapt your strategies to match shifting market dynamics.

- Leverage UGC: Encourage and incorporate user-generated content. This will foster deeper engagement with your audiences.

- Embrace Gaming: Consider the impact and opportunities presented by the gaming sector. Understand and leverage the potential of gaming communities to amplify your brand or product. (source: Deloitte’s 2023 Media and Entertainment Industry Outlook)

Resources

- Wellfound’s — Top Entertainment Industry Startups In 2023

- TechCrunch — “Imagine Impact, a content accelerator that launched two years ago under production powerhouse Imagine Entertainment to impart a “Y Combinator” approach to sourcing new work and connecting it with production opportunities”

- IBC2023 — Accelerator Media Innovation Programme

Media and Entertainment VCs to Consider

Baseline Ventures

About: Baseline Ventures is the investment firm of renowned angel investor Ron Conway. Recently ranked #6 in Forbes’ “Midas List” of top dealmakers, Conway was previously the founder and managing partner of the Angel Investors funds. That fund’s investments included a few names you may have heard of: Google, Ask Jeeves and PayPal.

Sweetspot check size: $ 1M

Lerer Hippeau

About: Lerer Hippeau is a seed and early-stage venture capital fund based in New York City.

Sweetspot check size: $ 5M

Thesis: Lerer Hippeau is an early-stage venture capital fund founded and operated in New York City. We invest in good people with great ideas who redefine categories — and create new ones entirely.

Flat6Labs

About: Flat6Labs is Sawari Ventures’ dedicated startup accelerator for seed stage investments.Sweetspot check size: $ 70K

Thesis: Flat6Labs in Tunisia is the leading seed and early stage venture capital firm investing in sector agnostic startups based in tunisia

Muse Capital

About: Muse Capital is a seed-stage fund that focuses on investing in entrepreneurs who are disrupting the consumer space.Check size: $ 100K – $ 500K

Founders Fund

About: Founders Fund is a San Francisco based venture capital firm investing in companies building revolutionary technologies.

Sweetspot check size: $ 40M

Thesis: We invest in smart people solving difficult problems.

Lightspeed Venture Partners

About: Lightspeed Venture Partners is a venture capital firm that is engaged in the consumer, enterprise, technology, and cleantech markets.

Thesis: The future isn’t built by dreamers. It’s built today, by doers.

Betaworks

About: Betaworks is a startup studio that builds and invests in next generation internet companies.

Sweetspot check size: $ 250K

Sinai

About: Sinai Ventures invests in internet and software founders at all stages.Sweetspot check size: $ 2M

Thesis: Sinai Ventures invests in internet and software founders at all stages.

Sweet Capital

About: Sweet Capital is the King (Candy Crush) founders’ fund, focused on backing ambitious founders of early-stage, consumer tech companies with positive impact

Precursor

About: An early-stage venture firm focused on classic seed investing.

Sweetspot check size: $ 250K

Thesis: We invest in people over product at the earliest stage of the entrepreneurial journey.

GV

About: The VC arm of Alphabet (Google’s parent) investing in the fields of life science, healthcare, artificial intelligence, robotics, transportation, cyber security, and agriculture. It was the most active CVC in 2017.

Sweetspot check size: $ 3M

Looking for Investors? Try Visible Today!

Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.

Related Resource: Media and Entertainment Investor connect profiles in our Fundraising CRM