6 Components of a VC Startup Term Sheet (Template Included)

Term sheets can be intimidating as a first-time founder. As it is likely the first time you’ve seen a term sheet, the intricacies of the deal can be difficult to understand. You can spend hours trying to understand a term sheet and what exactly makes up a “good” term sheet. As the team at YC writes, “we’ve noticed a common problem: founders don’t know what “good” looks like in a term sheet.”

If you’re looking for a breakdown of a term sheet specific to Series A, check out our blog post, “Navigating Your Series A Term Sheet.”

In order to help founders best understand their term sheets, many firms and individuals have come up with their own term sheet templates. In fact, many investors and founders now use a 1-page term sheet template. Check out our breakdown of term sheet components with a few templates below.

As a note, this is not legal advice and we suggest consulting with your lawyer while reviewing your term sheet.

Related Resource: How to Choose the Right Law Firm for Your Startup

VC Fundraising Timeline

As we often write about at Visible, we believe a startup fundraise shares a lot of characteristics of a B2B sales funnel. In the most simple breakdown — at the top of the funnel you are bringing in new investors, in the middle you are nurturing them through investor updates and meetings, and at the bottom, you are signing term sheets and building relationships with new investors.

Kicking off a VC Fundraise

Once you have formed your company and launched/are preparing to launch a product you may decide to pursue venture fundraising (to learn more about determining if VC funding is right for you, check out this post). Before kicking off a fundraise, especially at seed stages and later, you likely have some form of product-market fit.

Finding Investors

If you’ve decided VC funding is right for your business. You’ll need to start finding investors to “fill the top of your funnel.” Check out Visible Connect, our free investor database, to filter and find the right investors for your business. If you’re earlier in your company lifecycle and want to find angel investors, check out this post.

Pitching Investors

Once you start reaching out to investors (via cold email or warm intros) you’ll begin a series of meetings and pitches with the hopes of moving them down the funnel. Check out our template and guide for pitch decks here.

Related Reading: How to Write the Perfect Investment Memo

Due Diligence and Final Steps

If an investor is interested in moving forward, you will likely begin due diligence where they will audit your data, get feedback from customers and investors, and confirm their conviction in your company. If they decide to move forward, next comes a term sheet.

Term Sheet

At the end of a fundraise comes the term sheet. Assuming both parties are happy with the terms, you’ll be able to onboard your new investor.

6 Components of A VC Term Sheet

Liquidation Preferences

Liquidation preference is simply the order in which stakeholders are paid out in case of a company liquidation (e.g. company sale). Liquidation preference is important to your investors because it gives some security (well, as much security as there is at the Series A) to the risk of their investment. If you see more than 1x, which means the investor would get back more than they first invested, that should raise a red flag.

To learn more about liquidation preferences check out this article, “Liquidation Preference: Everything You Need to Know.”

Dividends

In the eyes of an early-stage investor, dividends are not a main point of focus. As Brad Feld puts it, “For early-stage investments, dividends generally do not provide “venture returns” – they are simply modest juice in a deal.” Dividends will typically be from 5-15% depending on the investor. Series A investors are looking to generate huge returns so a mere 5-15% on an investment is simply a little added “juice.”

There are 2 types of dividends; cumulative and non-cumulative. YC warns against cumulative dividends; “the investor compounds its liquidation preference every year by X%, which increases the economic hurdle that has to be cleared before founders and employees see any value.”

Conversion to Common Stock

Common practice will automatically convert preferred stock into common stock in the case of an IPO or acquisition. Generally, Series A investors will have the right to convert their preferred stock to common stock at any time. As Brad Feld puts it, “This allows the buyer of preferred stock to convert to common stock should he determine on a liquidation that he is better off getting paid on a pro-rata common basis rather than accepting the liquidation preference and participating amount.”

Voting Rights

On a Series A term sheet, the voting rights simply states the voting rights of the investor. Generally, your Series A investors will likely receive the same number of votes as the number of common shares they could convert to at any given time. In the Y Combinator example, as with most term sheets, this section can include some technical jargon that is not easy to understand.

The most important vetoes that a Series A investor usually receives are the veto of financing and the veto of a sale of the company.

Board Structure

One of the more important sections when navigating your Series A term sheet is the board structure. Ultimately, the board structure designates who has control of the board and the company. How your Series A investors want to structure the board should be a sign of how they perceive you and your company.

The most “founder-friendly” structure is 2-1. A scenario in which 2 seats are given to the common majority (e.g. the founders who control a majority of the common stock) and 1 given to the investors. This allows founders to maintain control of their company.

On the flip side, there is a 2-2-1 structure (2 founders, 2 investors, 1 outside member). In this scenario, it is possible for the founders to lose control of the company. While a common structure, be sure that the board structure is in line with conversations while fundraising. As Jason Kwon of YC puts it, “So when an investor says that they’re committed to partnering with you for the long-term – or that they’re betting everything on you – but then tells you something else with the terms that they insist on, believe the terms.”

Drag Along

As defined by the Morgan Lewis law firm, “Drag along is the right to obligate other stockholders to sell their securities along with securities sold by the investor.” Drag along rights give investors confidence that founders and the common majority will not block the sale of a company. While there is no way around drag-along rights, some people will suggest that founders negotiate for a higher “trigger point” (e.g. ⅔ votes as opposed to 51%).

You can learn more about drag along clauses in this post, Demystifying the VC term sheet: Drag-along provisions.

VC Term Sheet Examples

The Y Combinator Term Sheet Template

With thousands of investments under their belt, Y combinator is always a great place to start when looking for startup best practices. The team at YC put together an awesome 1 page term sheet template (with a focus on Series A) that any founder can use. While your actual term sheet may look different the Y Combinator Term Sheet template is a great place to get familiar with the subject.

YC does a great job of breaking down the different components and laying out terms and language that founders should keep their eye out for. Check out their term sheet template here.

Buffer Series A Term Sheet

The team at Buffer raised a $3.5M Series A back in 2014. Check out the signed term sheet and the terms from their raise here.

VC Term Sheet Templates

As term sheets are a necessary part of any fundraise there are hundreds of templates and examples to choose from by the investors, founders, and lawyers that have been there before. Check out a few popular templates below:

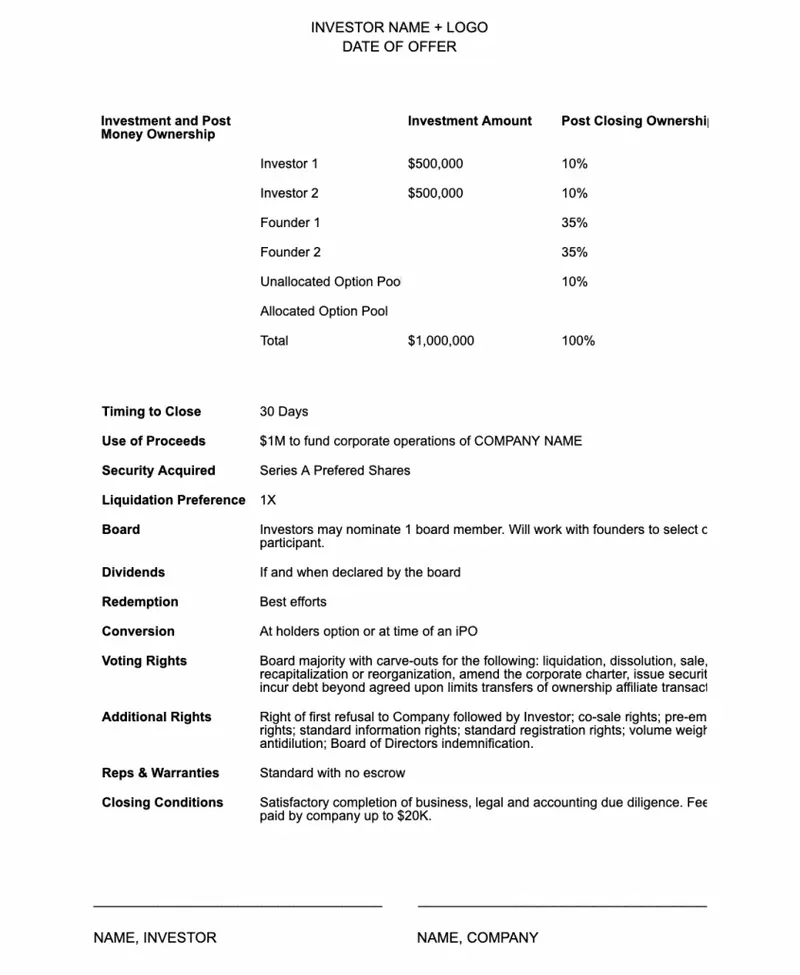

The One Page Term Sheet Template from Ben Milne

Ben Milne, Founder of Dwolla, has spent his fair share of time navigating term sheets. Ben is a Midwest founder and has seen the amount of time midwest founders and investors waste negotiating term sheets. As he put it, “Midwest investors and founders lose a lot of time trying to figure out the term sheet. Sometimes, they lose even more time deciding what the terms should be.”

In order to help bring some guidance to both startups and investors, Ben put together a one-page term sheet template. You can check out the template below:

You can check out the one-page term sheet template from Ben Milne in this blog post.

The NVCA Term Sheet Template

The National Venture Capital Association recently released their latest version of their term sheet template. As the team put at NVCA wrote, “The Enhanced Model Term Sheet allows an investor to draft term sheets while comparing terms against market benchmarks. Version 2.0 is powered by a database that now includes more than 100,000 venture transactions, representing over 40,000 investors with a combined network of over $1 trillion in assets under management.”

Check it out and download the template here.

Let Visible Help

We are here to help with any fundraise. Use our free investor database, Visible Connect, to kick off a raise. From here, use our fundraising CRM as you move investors through your funnel and sign a term sheet. Start your free trial here.