In the first half of 2023, Visible remained dedicated to helping our community of 350+ investors streamline the way they collect, analyze, and report on their portfolio data. We saw the slowdown in Venture Capital activity during the first part of the year translate into an increased need for accurate and up-to-date portfolio insights that can easily be shared internally and with stakeholders. Both Venture Capital investors and their Limited Partners are relying on data-informed insights more than ever before to guide their next steps.

To best support our investors, we focused on making updates to three core functions of our portfolio monitoring and reporting platform during the first half of 2023:

Keep reading to learn about some of the specific updates made to our platform during the last six months.

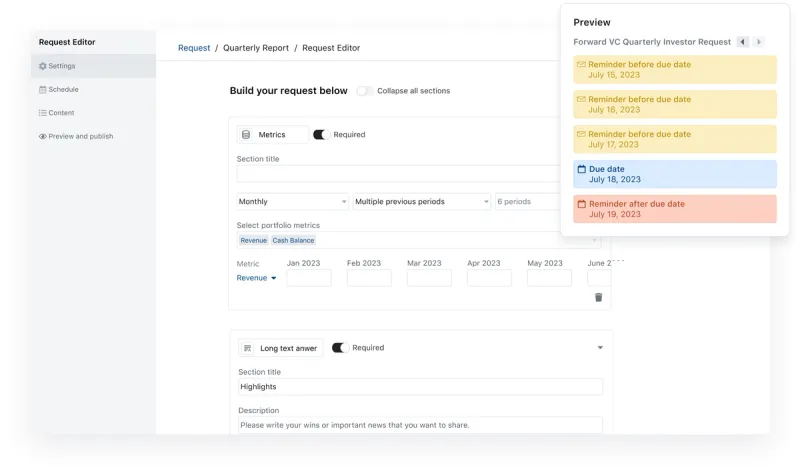

Changes to Getting Data into Visible

These product updates allow investors to more easily collect budget vs actuals KPI’s and send reminder emails to all their companies at once.

- Send bulk one-off reminders to all companies (learn more)

- Ask for up to six future and historical custom KPI’s (learn more)

- View and edit company metrics in dynamic time periods

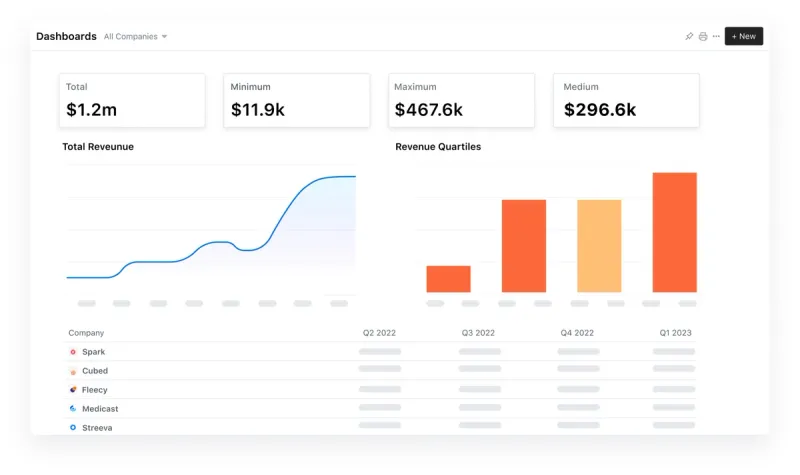

Changes to Visualizing, Analyzing, and Sharing Portfolio Insights

With these changes, users can more easily identify quick insights about their portfolio performance and share it with their team and LPs.

- Extract quick insights about your portfolio with Portfolio Metric Dashboards (learn more)

- Applying a custom dashboard template to all companies (learn more)

- Build a flexible One Pager template for LP reporting (learn more)

- Uplevel your data visualizations by adding color gradients to your charts (learn more)

- Share your portfolio company dashboards via a link and choose to password-protect them (learn more)

Learn more about analyzing portfolio data with custom dashboards in Visible.

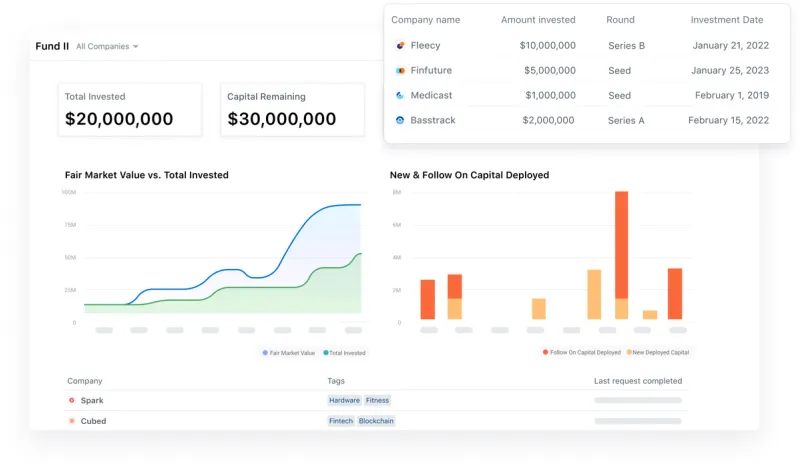

Changes to Investment Data Tracking

The following updates allow investors to track all their key investment data and fund metrics within Visible. This gives investors real-time control over updating, visualizing, and sharing their fund performance.

- Convert Convertible Notes to equity with ease (learn more)

- Track follow-on rounds you don’t participate in (learn more)

- Choose a custom exchange rate for investment round details (learn more)

- Capture all your core fund metrics in Visible (learn more)

- Track and visualize IRR at the fund and company level (learn more)

- Visualize auto-calculating fund metrics (learn more)

Ready to improve your firm’s portfolio monitoring and reporting processes?